Welcome to the HeavyFinance performance review, where we break down the loans that were given and repaid, as well as summaries the investor returns. To see the report from the previous month click here.

Investors financed 762K EUR of agricultural projects in September on HeavyFinance. The capital was spread around 31 loans.

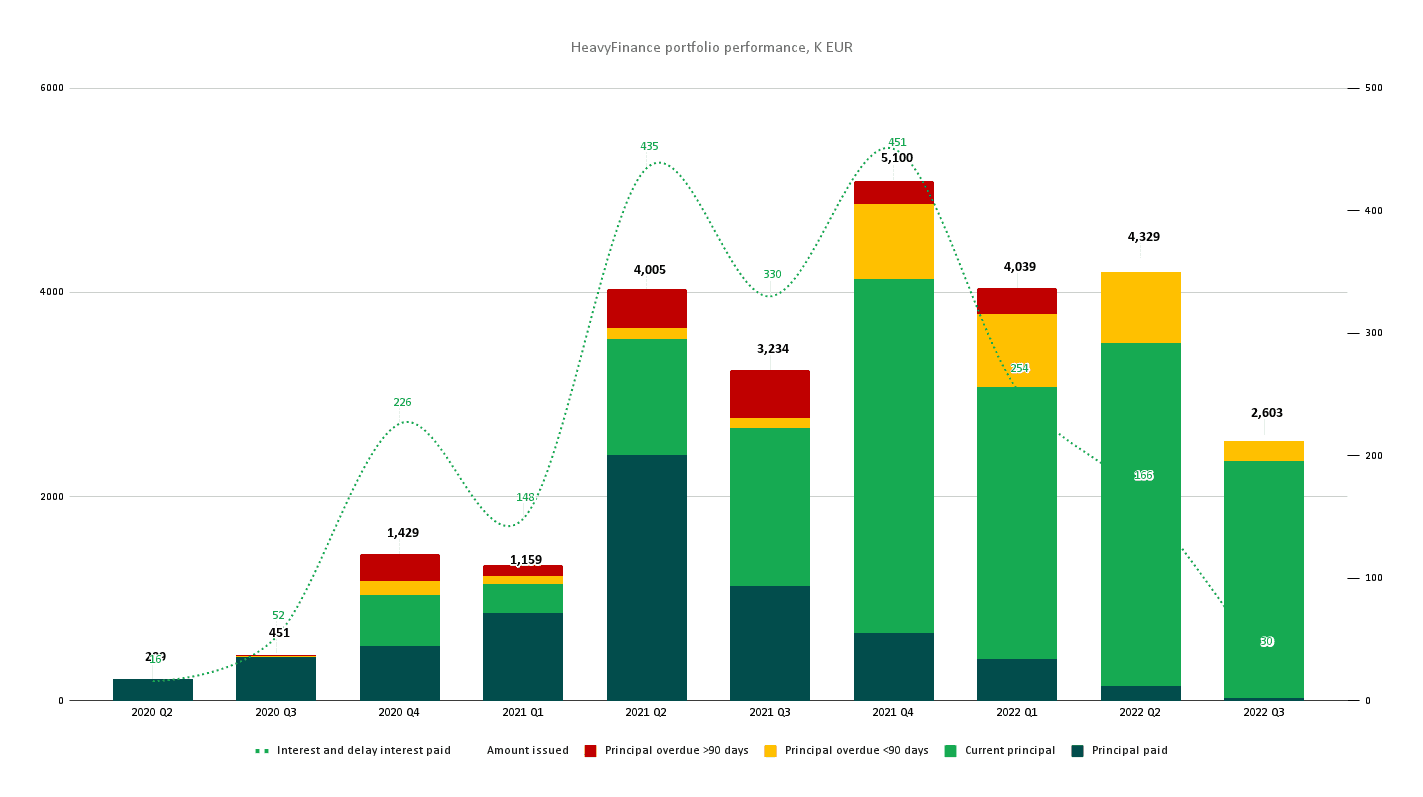

In total, 26.5M EUR were issued to the farmers till the end of September 2022. To date, the 6.8M EUR principal is already repaid to investors together with 2.11M EUR in interest.

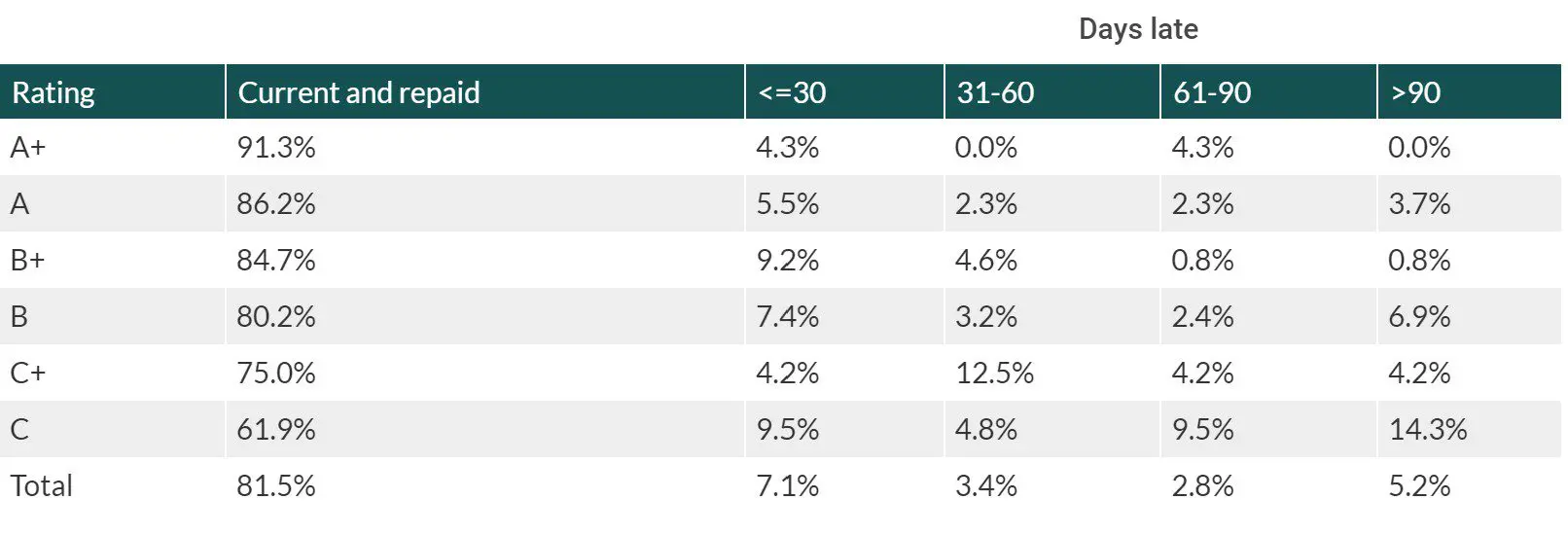

Currently, 83% of loans are being paid on time or are already repaid. The overdue principal of more than 90 days is 1.72M EUR – a healthy level of 6.5% of the issued amount.

It is worth mentioning that ratings B+ and C+ were introduced at the beginning of 2022, therefore, there are fewer defaults in this rating category.

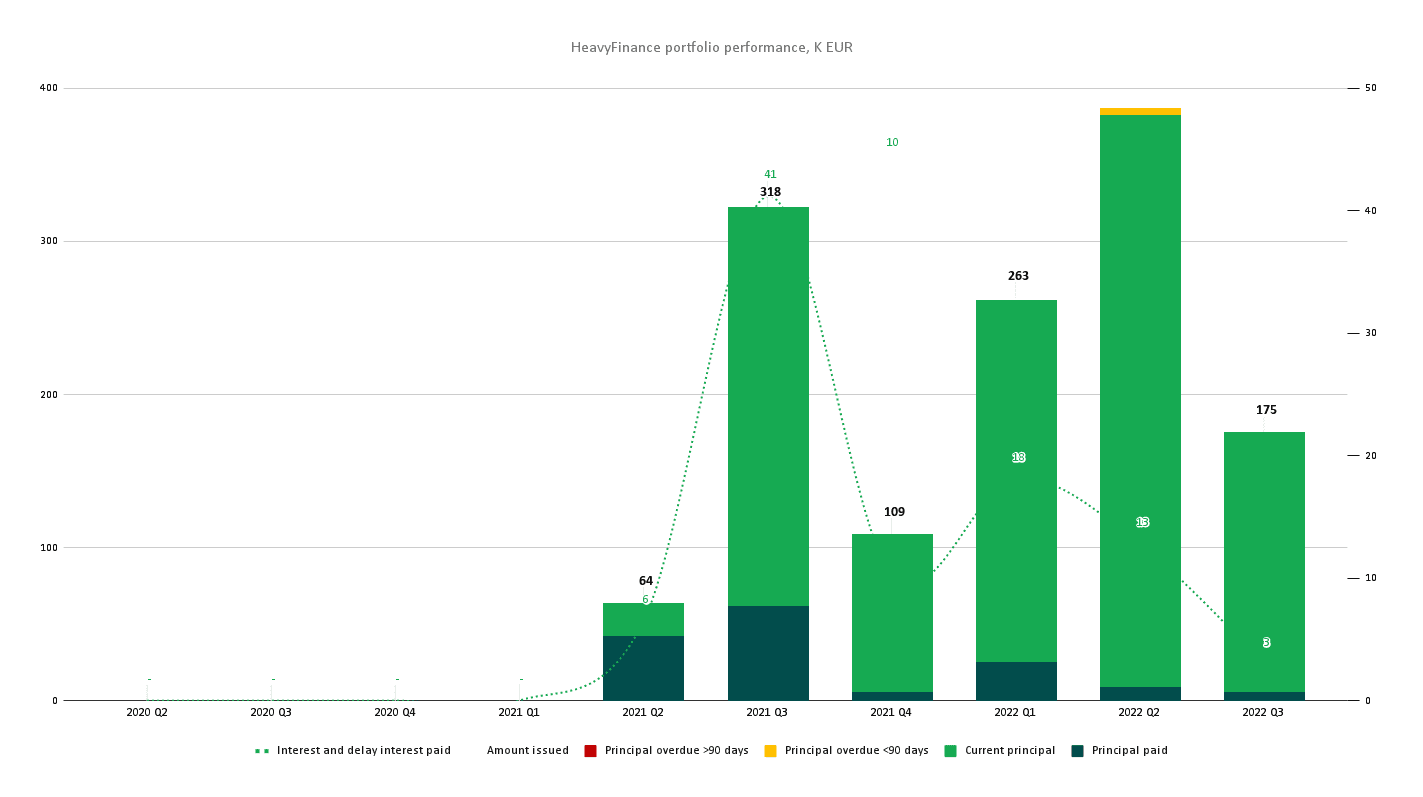

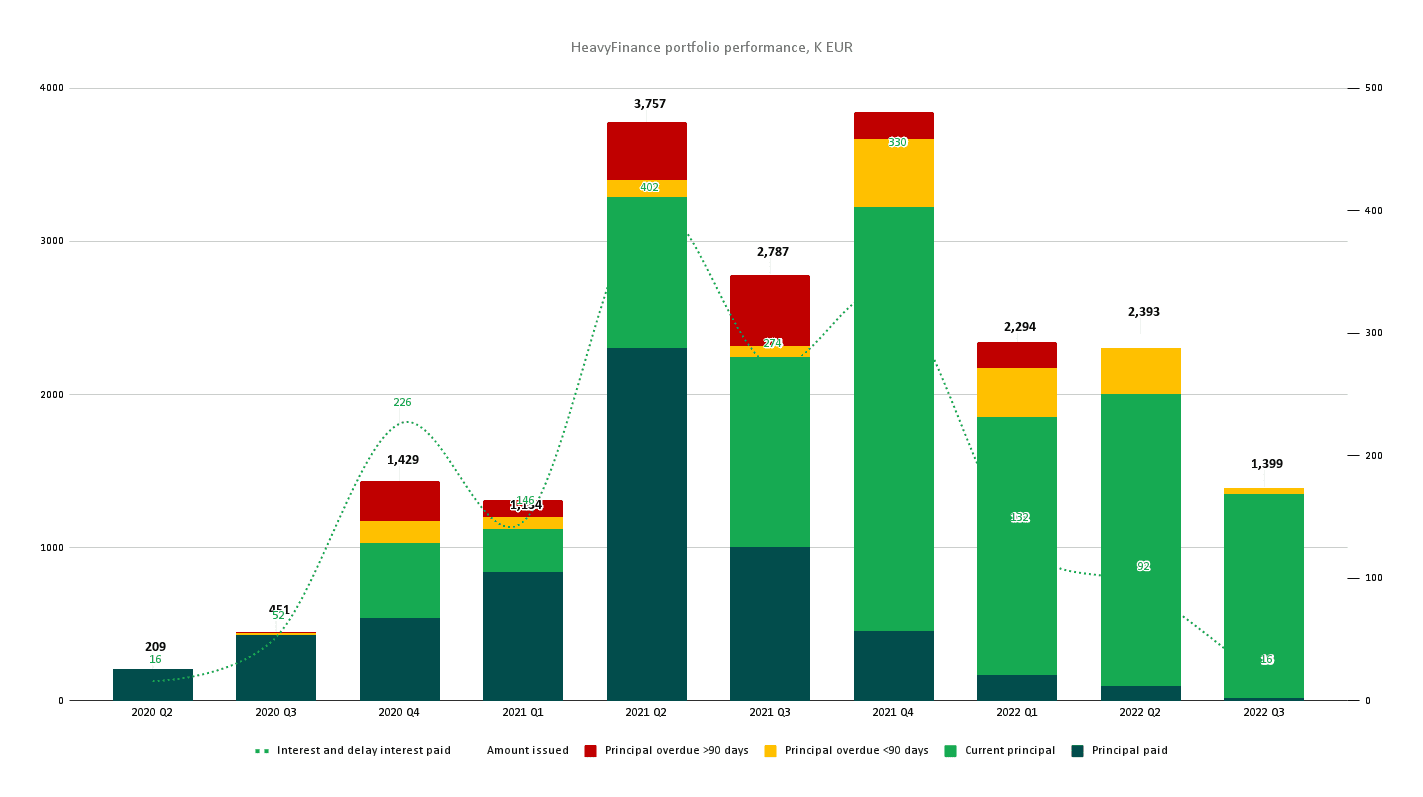

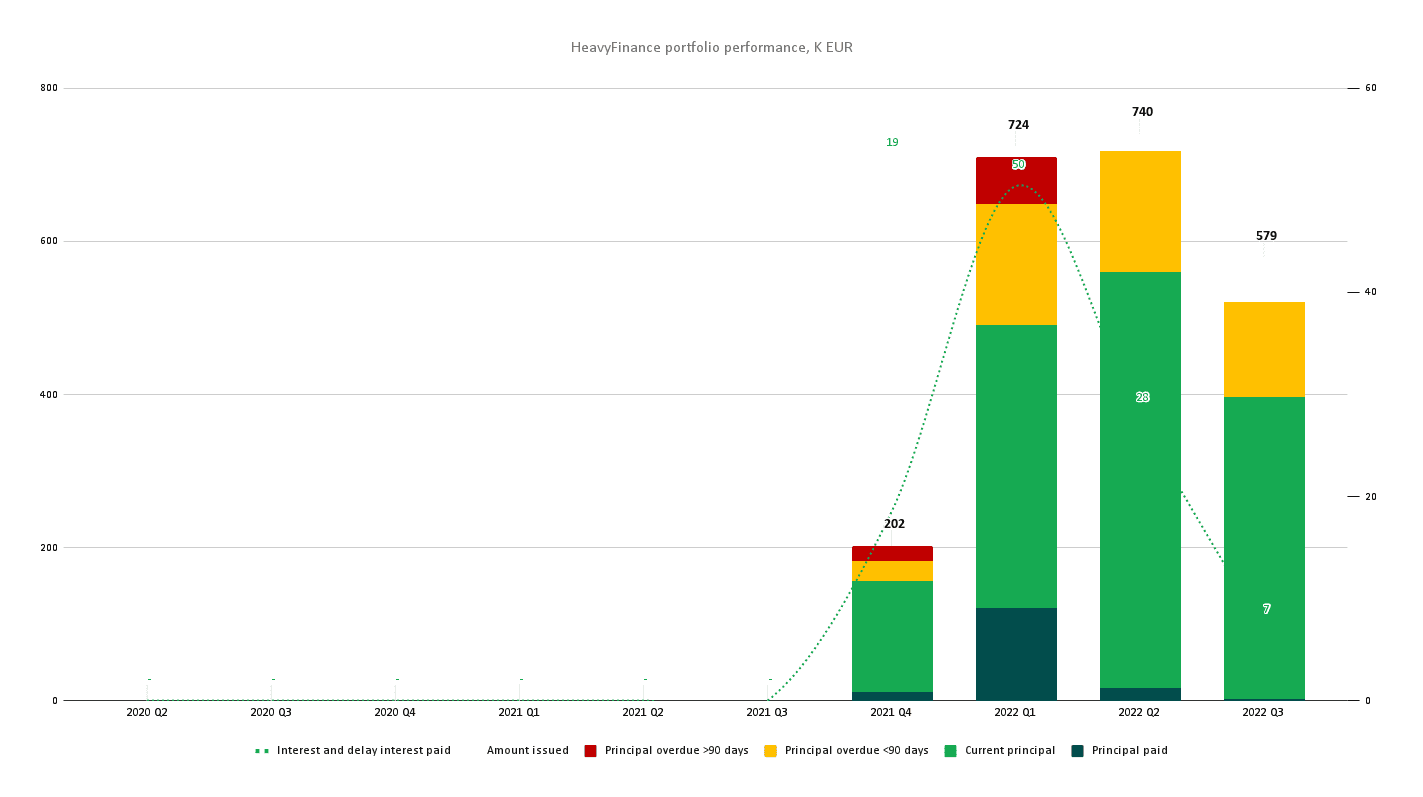

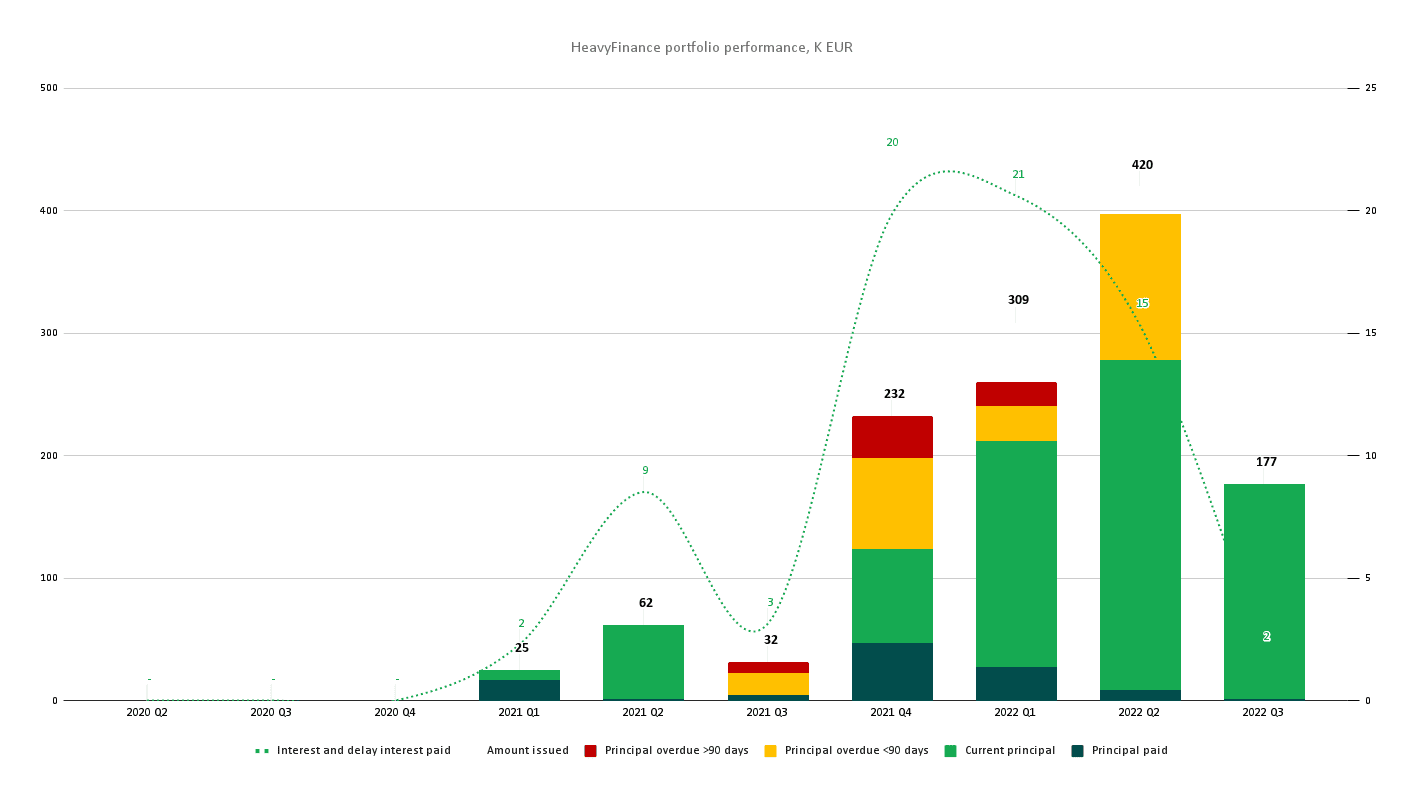

The graph below shows the loan originations, principal repayments, and interest payments for each quarter. Let’s take Q3 2020 as an example. Over this period, 451 thousand EUR of loans were funded, of which 430 thousand EUR have already been repaid together with 52 thousand EUR of interest. 11 thousand EUR is late for less than 90 days and 9 thousand EUR is currently more than 90 days overdue. (If at least 1 instalment is overdue, we treat the whole principal amount as being late).

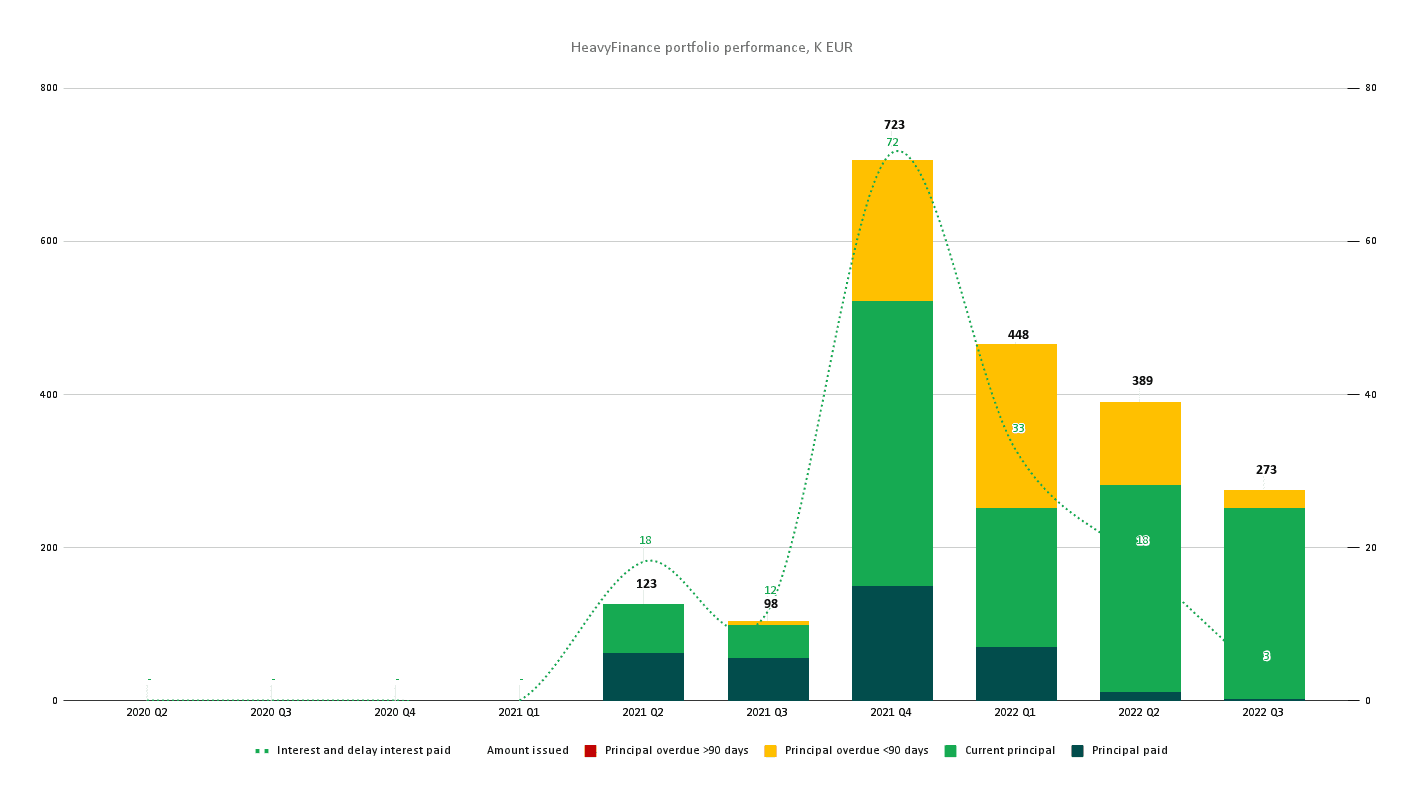

Bulgaria

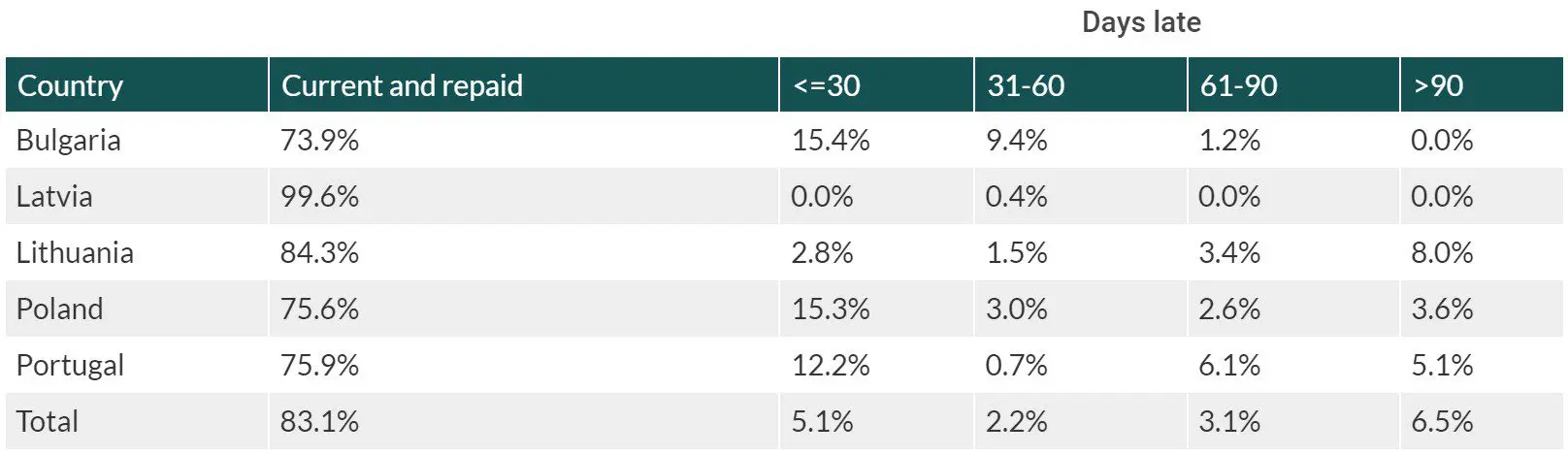

During the whole period (since April 2021), 2.05M EUR of loans were issued in Bulgaria and 74% of these are being paid on time or have been repaid already earning investors 155K EUR of interest. No loans are overdue for more than 90 days.

Update on delayed loans:

BG0000410 – a partial payment of 3500 EUR was received at the end of September.

BG0000634 – a partial payment of 700 EUR was received in mid September.

BG0000681 – a partial payment of 2000 EUR was received at the end of September.

Other late farmers are promising to pay in October.

Latvia

During the whole period (since May 2021) 1.32M EUR of loans were issued in Latvia. 99.6% of loans issued are being paid on time or have been repaid already earning investors 92K EUR of interest. No loans are overdue for more than 90 days.

Lithuania

During the whole period (since June 2020), 19.7M EUR of loans were issued in Lithuania, 84.3% of loans issued are being paid on time or have been repaid already earning investors 1.69M EUR of interest. 1.58M EUR is overdue for more than 90 days.

The challenging weather of September did not prevent farmers from finishing the harvest, who also managed to sow crops for the new season. The good news is that the majority of farmers are looking for ways to save cultivating costs, therefore the old method of field cultivation, plowing the soil with plows is becoming more and more unpopular. We can confirm that the majority of farmers buy modern seed drills that are able to insert the crop directly into the stubble, and the pros are that with the mentioned seed drill the field is cultivated only once, where previously it required the tractors to drive through the same field at least three times.

While the farmers are satisfied with the harvest – the HeavyFinance team is capitalizing on the recovery. Farmers whose contracts have been terminated and forced debt collection has been started are actively communicating with the team and gradually covering overdue payments.

Poland

During the whole period (since December 2021) 2.25M EUR of loans were issued in Poland. 76% of loans issued are being paid on time or have been repaid already earning investors 103K EUR interest. 80K EUR is overdue for more than 90 days.

Update on defaulted loans:

PL0000501 – the documents have been submitted to the court. The HeavyFinance legal department is in constant contact with the court.

PL0000521 – legal procedures are going according to official terms which are not in HeavyFinance’s power to speed up. The restructuring advisor was contacted nonetheless and we are waiting for his response.

PL0000417 – entered a restructuring process with a restructuring advisor. HeavyFinance is waiting for the advisor’s proposal and if all parties (including other lenders) agree to a new payment schedule – it will be presented and accepted in court.

PL0000814 – the farmer is in contact with us and is struggling with payments. Hopefully, he’ll cover all late installments after receiving money from the harvest. A paper notice has been sent with a reminder of late payment.

PL0000437 – despite the best effort of our operations team we weren’t able to contact the farmer since July (neither by phone, email, nor SMS). Another paper notice has been sent with a reminder of late payment and possible contract termination.

PL0000416 – a small payment has been made, but the HF team is in contact with a farmer who promised to cover any late installments after the harvest is over.

PL0000815 – despite the best effort of our operations team we weren’t able to contact the borrower since July (neither by phone, email, nor SMS). A paper notice has been sent with a reminder of late payment.

Portugal

During the whole period (since December 2021) 1.26M EUR of loans were issued in Portugal. 76% of loans issued are being paid on time or have been repaid already earning investors 71K EUR interest. 64K EUR is overdue for more than 90 days.

This is a critical time for Portuguese farmers. These past months were very cash intensive for the farming activity and a lot of farmers are selling their productions and waiting for payment from buyers.

Defaulted loans update:

PT0000310 – waiting for further developments in the court.

PT0000449 – claims to have been with a prolonged disease in bed for 4 months and was not able to capitalize on this year’s harvest. Started to work last month and proposed to pay 300 EUR per month (the original installment was 270 EUR).

PT0000469 – waiting for further developments in the court.

PT0000209 – waiting for further developments in the court.

PT0000512 and PT0000457 – contacted HeavyFinance after court notification – negotiating a repayment plan.

PT0000581 – the farmer contacted us before entering the court procedure, wanted to avoid it but did not pay anything yet.

Recovery

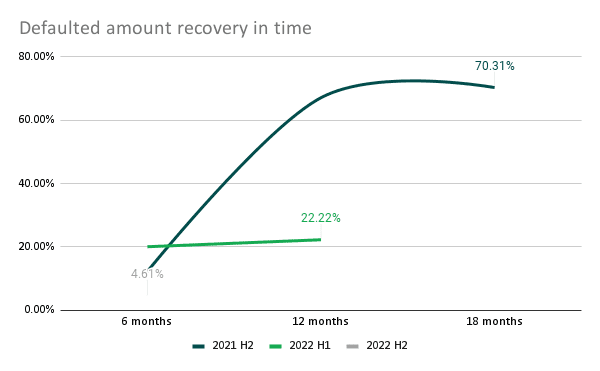

During September 137K EUR were recovered from defaulted loans and distributed to investors. A total recovered amount from defaults amounts to 419K EUR.

In the chart below recovery in time is presented. From the loans which defaulted in 2021 H2 HeavyFinance already recovered 70.31%.

As the majority of the farmers are finalizing their harvest and payments are expected within 30 to 90 days from the delivery – HeavyFinance investors can expect a large influx of loan repayments in Q4, 2022.

Happy investing!

HeavyFinance team