Impact

investing for

planet and

profit

Fund Green Loans to help farmers adopt sustainable practices and receive returns from carbon credits generated on the farm.

19.5%

Average return

700k

CO2 removed

13,000

Investors

Why Agriculture and Green Loans Deserve a Place in Your Portfolio?

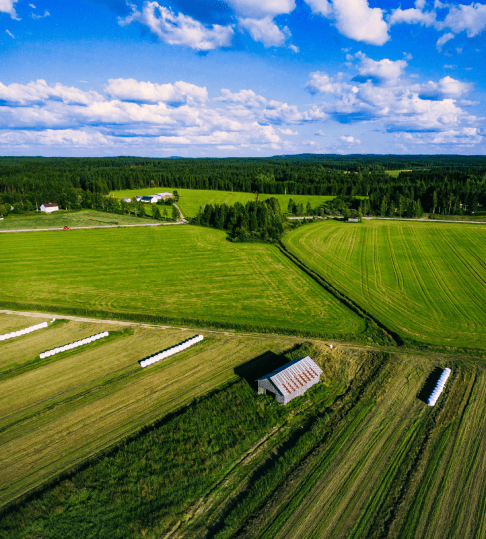

Agriculture has always been an essential part of the global economy, providing food and raw materials for various industries. However, driven by shifts in eating habits, population growth, climate change, and failing soils, our food and agriculture industry faces moonshot-sized challenges, presenting significant impact investing opportunities.

Inflation-proof Your Portfolio

Feed a Growing Population & Enhance Food Security

Positive Social and Economic Impact

The agriculture sector provides jobs for approximately 1 billion people globally. Your passive investment will help keep farmers in the business of farming, create employment opportunities, and encourage small business growth.

Food System Connection

We all know why sustainability is important. It’s time to invest in it.

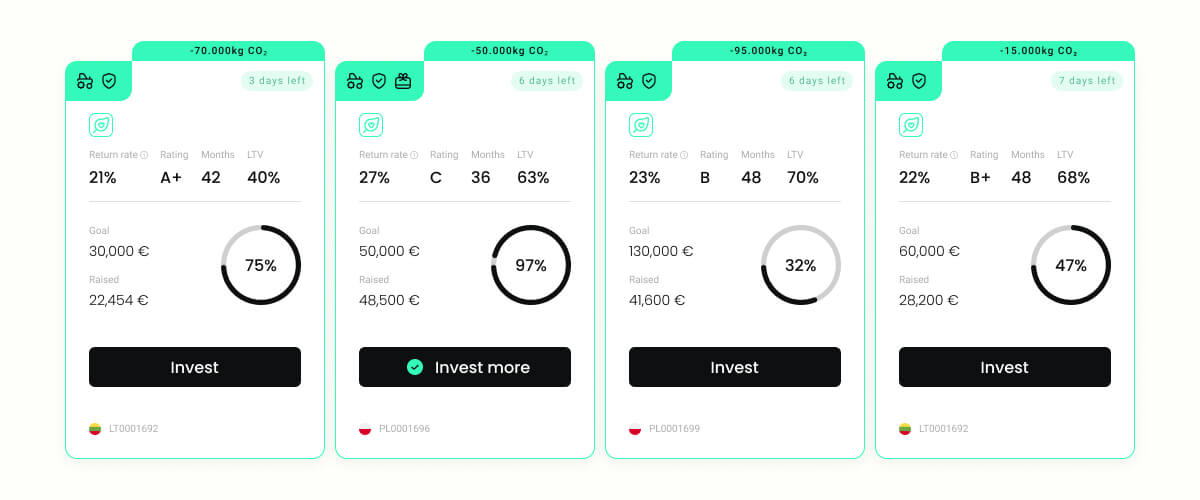

Green Loans are marked with a sign of a green leaf with a heart inside. Before even opening each project, you will also notice CO2 emissions to be removed if the project gets needed funding.

How does Green Loans work?

Borrowers

Farmers across Europe seek quick, flexible financing to support their agricultural projects. With competitive interest rates, they can access financing to adopt more sustainable practices like no-till farming, replacing chemical fertilisers with organic and biological ones.

HeavyFinance

Our team combines finance, agriculture and climate change mitigation expertise to evaluate loan applications. With assistance from HeavyFinance agronomists, soil and data scientists, farmers generate carbon certificates.

Investors

With as little as €100 anyone can invest in loans for European farmers to grow healthier food with a positive environmental impact.

Investment terms - Green Loans

Terms

- Loan period: up to 48 months

- Annual partial repayments

- First-hand collateral on land with up to 90% loan-to-value ratio and on heavy equipment with up to 70% loan-to-value ratio

Returns

- Investors receive 60% of carbon credits sold during the loan period with bi-annual repayments.

- After the loan is repaid in full, investors receive 40% of carbon credits sold for one more year.

What are Carbon Credits?

Carbon certificates are tradable units, each representing the removal of one tonne of carbon dioxide from the atmosphere.

Farmers participating in carbon farming project generate certificates by storing carbon in the soil.

1 tonne of CO2 removed = 1 Carbon Certificate

Through cooperating with HeavyFinance, investors can benefit from the positive impact of reducing emissions while also earning returns from the sale of the certificates.

Choose where to invest

Agriculture as an asset class provides passive income and a hedge against inflation, and it’s an attractive investment for a diversified portfolio. These investments provide tangible yield derived from naturally produced products with little to no correlation to the overall stock market and lower risk of loss during market corrections.

Green Loans

Green Loans are designed to benefit investors, farmers and the environment. By supporting regenerative farming through HeavyFinance, your investment contributes to combating climate change. It offers a unique sustainable investment opportunity by giving you access to the global carbon credit market.

Agricultural Loans

Agricultural loans on HeavyFinance enables investors to earn stable passive income from a sector of strategic importance - agriculture. With a diverse portfolio of farmers across five European countries, this loan type offers secure investment opportunities with high diversification.

The transition toward a more environmentally sustainable, socially inclusive world will create unprecedented financing opportunities and reallocation of capital flows. It’s time to invest in it.

From polluter to sequester

Meet farmer Donatas, a sustainable farmer. In stages, he has been implementing regenerative land management across all of his 330 hectares of farmland since 2017.

To employ regenerative agricultural practices throughout the fields, the farmer received a loan from the HeavyFinance investor community to purchase a disc cultivator Carrier XL 425-625. The loan amount is 105.000€ with a three-year loan period.

He took a 0% interest Green Loan, as 134 ha of his soil can capture and store 3 tonnes of CO2 per hectare per year. Investors of this loan are getting returns from carbon certificates that the field generates.

The expected market price for these high quality carbon certificate is 35€. In 36 months, the investor would receive their initial 105,000€ investment back. Following the conservative scenario, investors in this loan will earn 13% annualized returns generated from the sale of the carbon certificates over the next 10-year period.

Ready to start your impact investing journey?

Grow your wealth. Invest in sustainable agriculture.

Registration takes up to 10 minutes, you can pause and resume the process at any time.