Climate change is one of the biggest challenges facing humanity, and reducing greenhouse gas emissions is crucial in addressing it. One approach that has gained increasing attention in recent years is through the voluntary carbon markets. These markets provide a way for individuals and organisations to purchase carbon certificates to offset their emissions and support projects that reduce or remove carbon dioxide from the atmosphere.

Unlike compliance markets which are presently confined to certain regions, voluntary carbon certificates offer much greater flexibility as they are not constrained by the boundaries set by nations or political unions. Additionally, they have the potential to be accessible to all sectors of the economy rather than being limited to a select few industries.

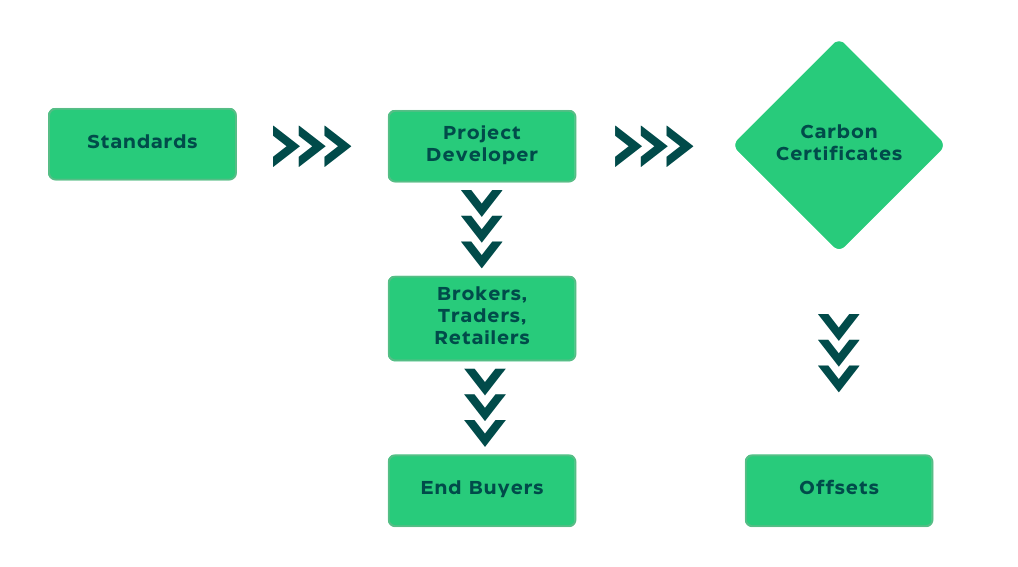

How the carbon certificate markets work?

A carbon certificate represents one metric ton of reduced, avoided or removed CO2. This unit can then be used to compensate for the greenhouse emissions of an individual or company that are environmentally conscious. Once a carbon certificate is used in such a manner, it becomes known as an offset and retires, thus making it untradeable.

The voluntary carbon market consists of several participants, including project developers, who set up carbon certificate projects to avoid or remove greenhouse emissions from the atmosphere.

Project Developers:

These are the organisations or individuals who develop and implement carbon reduction or removal projects. These projects can range from large-scale industrial projects like hydroelectric plants to smaller, community-based projects like clean cookstoves. Project developers are responsible for creating and managing the projects that issue carbon certificates.

End Buyers:

End buyers are typically companies or individuals who want to offset their greenhouse gas emissions by purchasing carbon certificates. End buyers can be from a wide range of industries, from tech companies and airlines to oil and gas majors. End buyers can offset part or all of their greenhouse emissions by purchasing carbon certificates from project developers.

Retail Traders:

Retail traders are intermediaries between project developers and end buyers. They purchase large amounts of carbon certificates directly from project developers and then bundle those into portfolios ranging from hundreds to thousands of equivalent tons of CO2, which they sell to end buyers. Retail traders typically earn a commission on the sale of these credits.

Brokers:

Brokers buy carbon certificates from retail traders and market them to end buyers, usually with some commission. Brokers act as intermediaries between the retail traders and the end buyers and facilitate the trade of carbon certificates.

Standards:

Standards are organisations, usually NGOs, that certify that a particular project meets its stated objectives and its stated volume of emissions. Standards have a series of methodologies, or requirements, for each type of carbon project. Standards’ certifications ensure that core principles or requirements of carbon finance are respected, such as additionality, no overestimation, permanence, exclusive claim, and providing additional social and environmental benefits.

Together, these participants create a functioning voluntary carbon market where project developers can create and sell carbon credits, and end buyers can purchase these credits to offset their emissions. Retail traders and brokers help facilitate the trade of carbon credits between project developers and end buyers, and standards ensure that projects meet certain requirements and certifications in order to create legitimate carbon certificates.

What does the carbon certificate price depend on?

- Type (removal certificates are more expensive than avoidance certificates)

- Volume of certificates traded

- Vintage of the project (typically, the newer, the pricier)

- Delivery time

- Quality

- Accordance to the UN’s Sustainable Development Goals

There are different types of credits, which can be grouped into two main categories: avoidance and removal. Avoidance projects, like renewable energy and efficient buildings, prevent emissions from happening in the first place. Removal projects, like reforestation and carbon capture, take carbon out of the atmosphere. Removal credits tend to be more expensive because they’re seen as more effective in fighting climate change.

The price of carbon credits also depends on factors like the volume of credits traded, the vintage of the project, and the delivery time. And if a project also helps meet some of the UN’s Sustainable Development Goals, its credits may be more valuable.

Community-based projects, which are managed by local groups and often have additional benefits like improving local welfare and water quality, may trade at a premium compared to larger industrial projects that don’t meet the SDGs.

The quality of a carbon certificates is a crucial factor in determining its price on the market. Reputable project developers who can demonstrate real results, have a competent scientific team, follow robust methodology, and maintain transparency, are able to command the highest prices for their carbon certificates. This is because buyers place a high value on credits that are reliable and verifiable, and can contribute to meaningful reductions in carbon emissions.

All in all, the price of a carbon credit can vary from just a few cents to hundreds of dollars, depending on the project type and other factors.

The future of voluntary carbon markets

Voluntary carbon markets offer a flexible and accessible way for individuals and organisations to offset their carbon emissions and support sustainable projects that reduce or remove carbon dioxide from the atmosphere. HeavyFinance is a Verra Verified Carbon Standard project developer with a strong focus on sustainability and transparency, making it a wise choice for investors looking to make a positive impact while also seeing a return on their investment.

By adhering to rigorous methodologies and working with a team of experienced professionals, HeavyFinance is able to offer carbon credits that deliver real and verifiable results. Additionally, HeavyFinance is committed to working towards the United Nations Sustainable Development Goals, which helps to ensure that their carbon credits are highly valued in the market and can command the best prices.

While the global economic crisis of 2008 slowed the growth of voluntary carbon markets, recent public and private commitments to reduce carbon emissions have led to a renewed interest in these markets. Although there are barriers, such as transparency issues and a limited understanding of carbon finance, the emergence of trusted and sustainable players like HeavyFinance is contributing to the growth of this market.

Looking to the future, it is likely that the demand for voluntary carbon credits will continue to rise as individuals and organisations seek to mitigate their carbon footprint. As more players enter the market and efforts to standardise operations continue, we can expect increased transparency and a better understanding of carbon finance, making voluntary carbon markets more accessible and attractive to a wider range of participants.