Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

In February, a total of 1.47M EUR was invested and distributed across 42 agricultural projects available on the HeavyFinance platform. As of the final of February 2024, a significant sum of 52.36 million EUR was issued in loans since the inception of HeavyFinance.

A positive trend worthy of mentioning is that year over year, we’re seeing a significant increase in repayment volumes. Our investors are seeing direct benefits of this in the form of interest with additional earnings from delayed interest.

To date, the principal of 22.38M EUR has already been repaid to investors with 5.17M EUR in interest and 876K in delayed interest. During February our investors received 1.44M EUR in repayments – of which 1.21M EUR principal, 166K EUR in interest, and 61K in delay interest. 642K EUR of repayments are scheduled for March 2024.

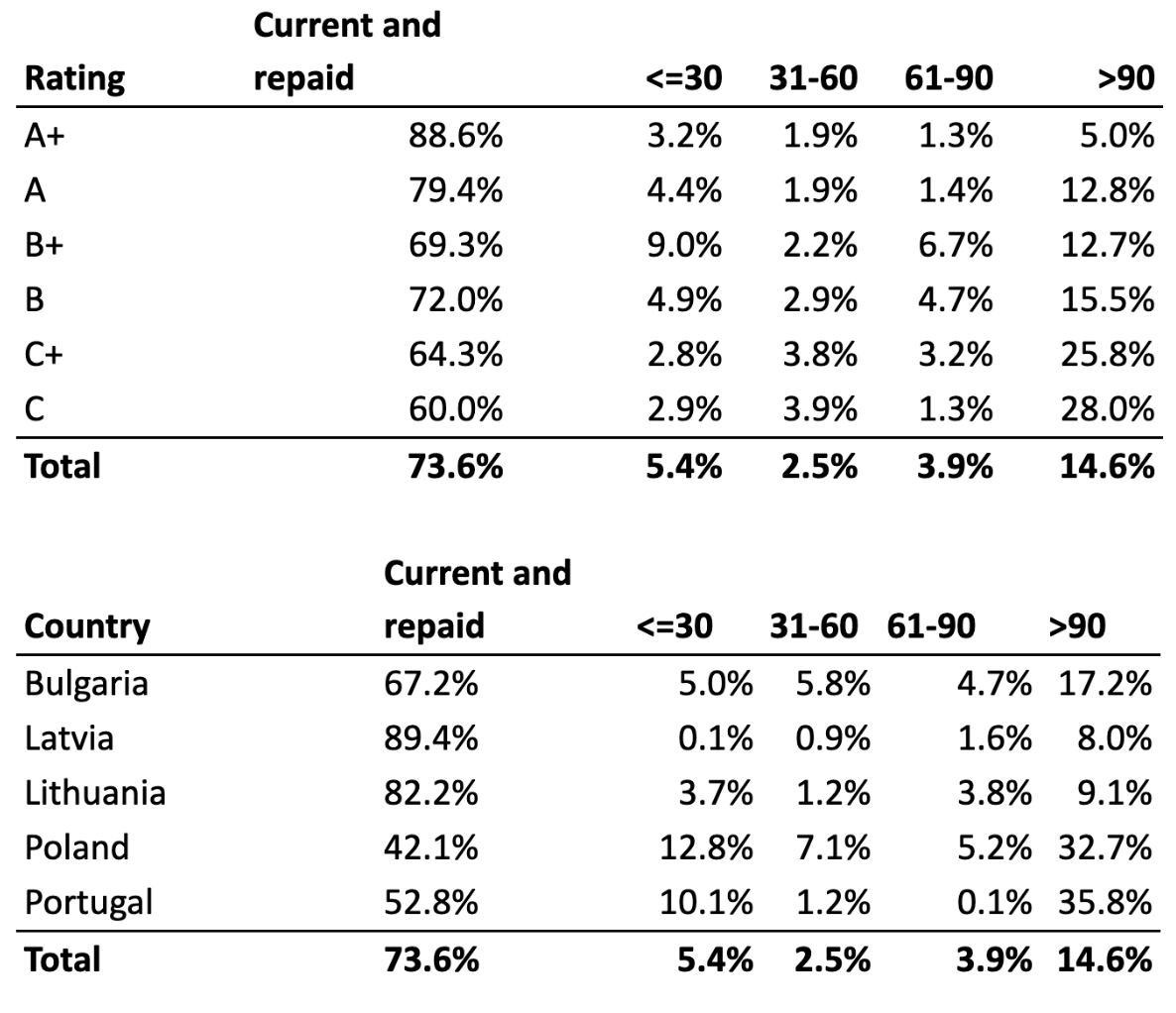

As of now, based on the repayment schedule, 73.6% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 7.66M EUR representing 14.6% of the total issued amount.

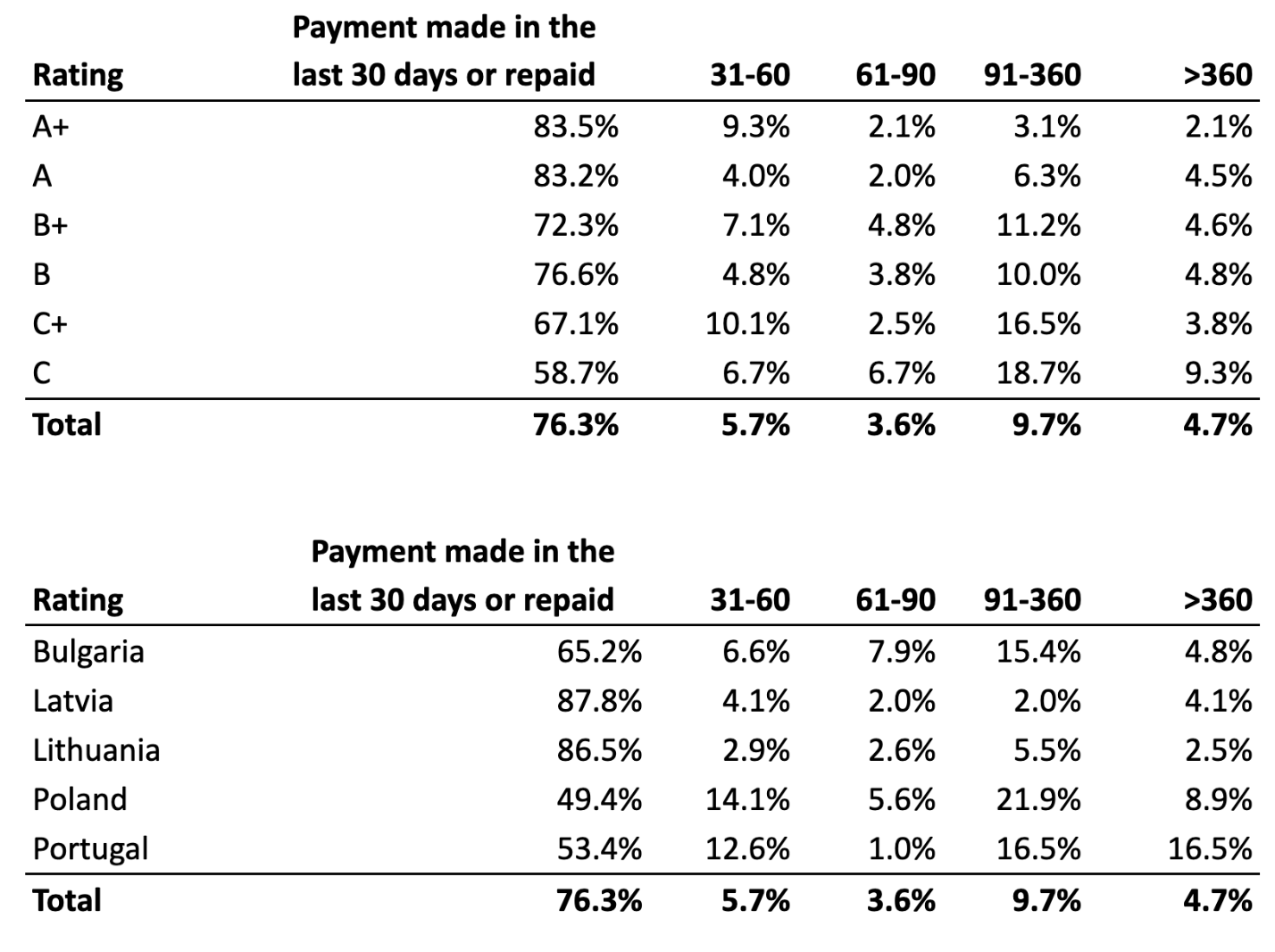

The below table demonstrates the farmers’ repayment habits in a more accurate manner by depicting loans with factual repayment delinquencies. As of now, 76.3% of the payments have either been made within the last 30 days or have already been fully settled.

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 876K EUR has already been repaid along with 186K EUR of interest. 82K EUR is being paid on time, 53K EUR is overdue for less than 90 days and 147K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

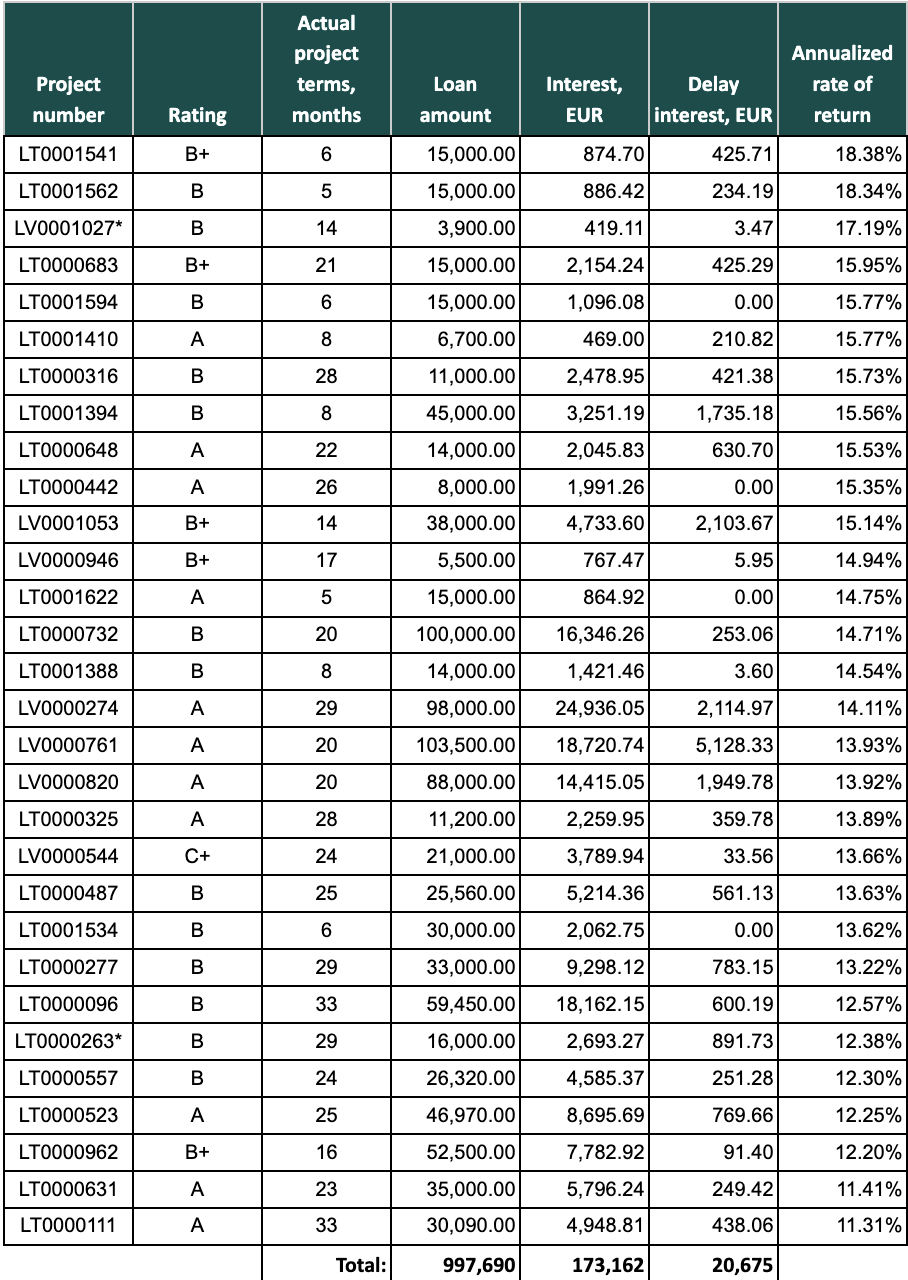

Fully repaid loans in February

In February, 30 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.91%. Notably, the factual return rate ranged from 18.38% to 11.31%. The total issuance for the loans amounted to 998K EUR. Investors received 173K EUR in interest and 21K EUR in delayed interest for the loans that were fully repaid during February.

*Two terminated loans were fully repaid in February, 2024.

LV0001027 terminated on 2023-04-14

The loan was secured with the personal surety of the company’s director. However, the borrower faced difficulties in keeping up with the payments, leading HeavyFinance to terminate the agreement. Following a court hearing on 2023-05-15, a positive decision was received, and the debtor was compelled to make a voluntary payment by 2023-06-01; otherwise, a writ of execution would be issued. By the end of the stipulated period, the debtor made three payments, with an additional four payments made after the deadline. The documents for the writ of execution were submitted on 2024-01-11, and following the submission, the debtor successfully covered the entire debt.

LT0000263 terminated on 2022-10-26

The loan was secured with land and buildings. In the summer of 2022, the borrower faced financial challenges, particularly in meeting agricultural obligations due to a significant decline in milk purchase prices, among other factors. After a delay of 76 days, HeavyFinance decided to terminate the loan agreement on October 26, 2022, and initiate forced debt collection. Following the notice of the debt collection process, four auctions took place, and the property was sold. However, before the completion of the sale of the property, an agreement was reached, and the borrower fully settled the debt with HeavyFinance. As a result, the forced debt collection was terminated upon the complete repayment of the loan.

Recovery

During February 2024, 55.1K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 2.01M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, resulting in a 110.35% recovery rate.

The agricultural sector is notably susceptible to seasonal fluctuations. Despite facing challenges, particularly evident in Poland during the previous year, farmers are actively strategizing to fulfill their commitments and establish mutually beneficial solutions with the investor community of HeavyFinance.

Overall, last year ended on a high note but the HeavyFinance team continues to address the financing gap in agriculture. Make sure to visit our project page to put your money to work.

Happy investing!

HeavyFinance team