Welcome to the HeavyFinance performance review! You can access the portfolio review from last month here.

In January of 2023 investors financed 1.45M EUR of agricultural projects through HeavyFinance, with the capital spread across 54 different loans.

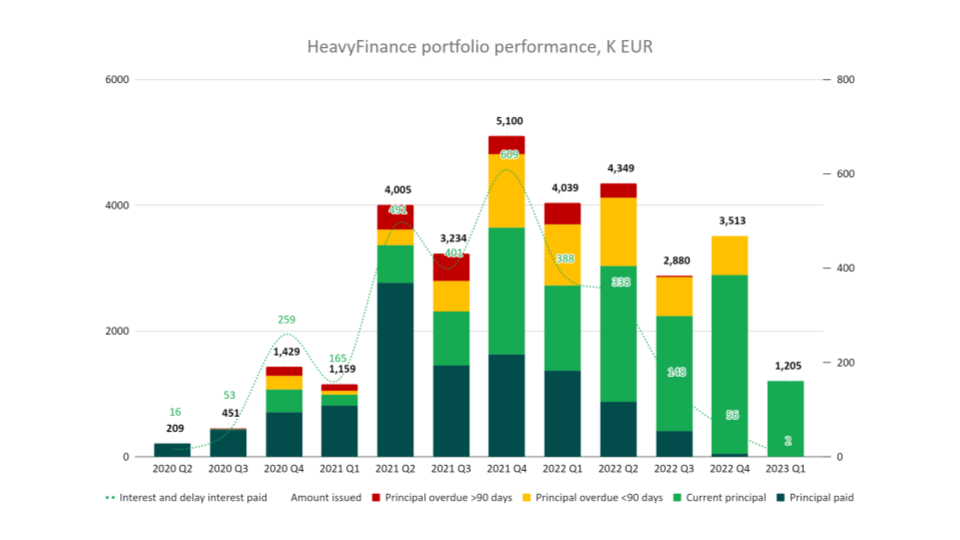

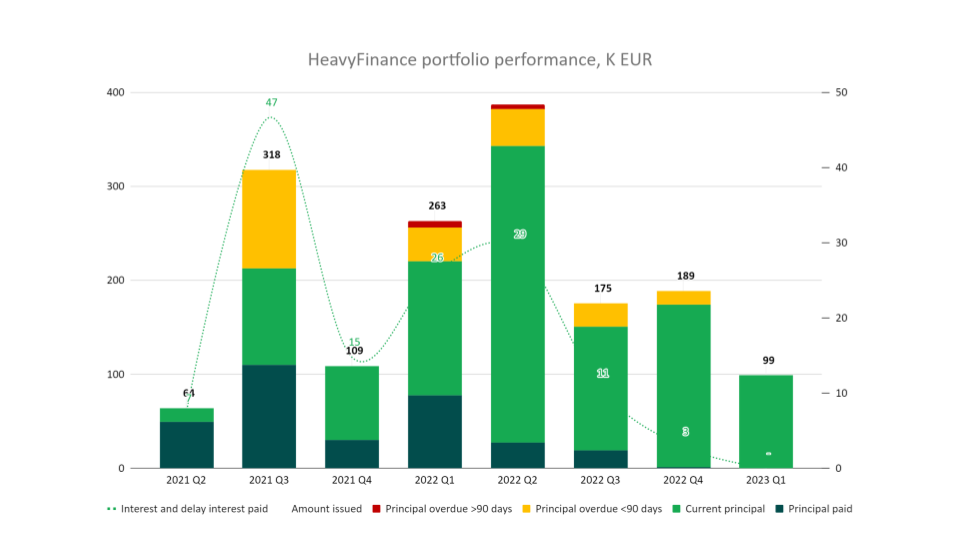

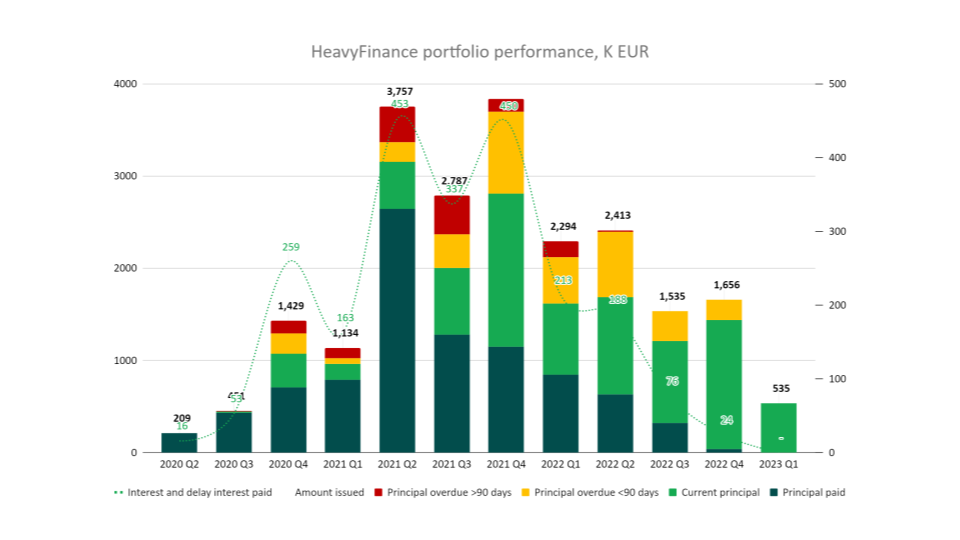

In total, 31.6M EUR was issued to the farmers up until the end of January, 2023. To date, 10.7M EUR principal has already been repaid to investors together with 2.9M EUR in interest. During January our investors received 1.2M EUR in repayments – 986K EUR principal, 161K EUR interest and 36K in delayed interest. 787K EUR of repayments are scheduled for February.

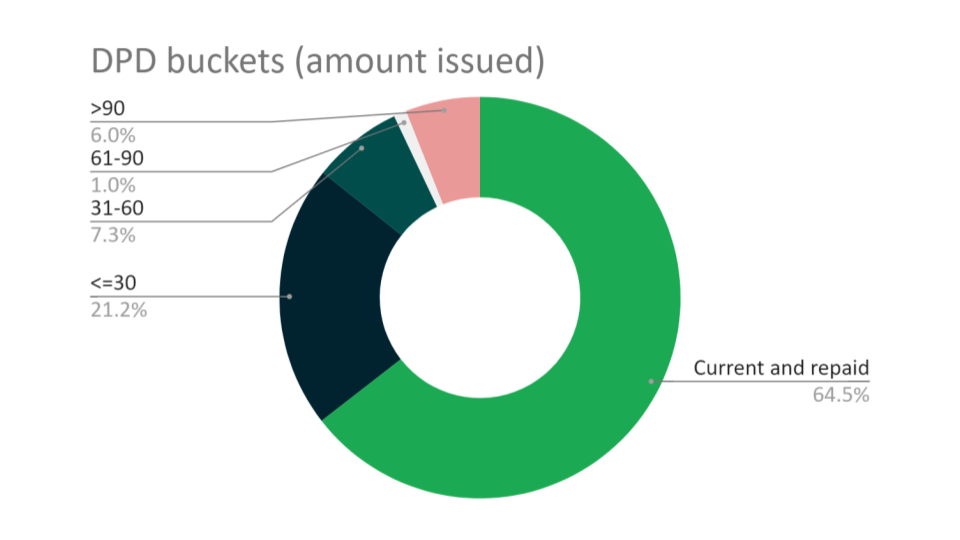

Currently, 76.4% of loans are being paid on time or have already been repaid. The overdue principal of more than 90 days is 1.96M EUR constituting a healthy level of 6.2% of the issued amount.

Rating | Current and repaid | <=30 | 31-60 | 61-90 | >90 |

A+ | 79.4% | 17.8% | 0.0% | 0.0% | 2.8% |

A | 80.6% | 2.7% | 12.4% | 0.7% | 3.6% |

B+ | 81.5% | 10.6% | 2.3% | 1.4% | 4.3% |

B | 75.4% | 8.1% | 5.4% | 2.7% | 8.4% |

C+ | 67.1% | 23.9% | 5.9% | 1.4% | 1.7% |

C | 53.7% | 26.4% | 2.3% | 2.1% | 15.4% |

Total | 76.4% | 9.2% | 6.5% | 1.7% | 6.2% |

Country | Current and repaid | <=30 | 31-60 | 61-90 | >90 |

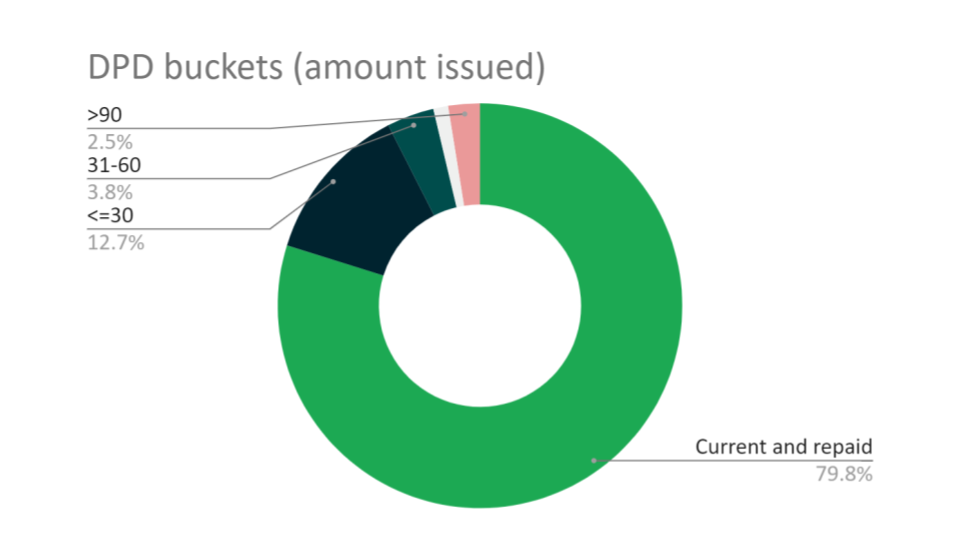

Bulgaria | 79.8% | 12.7% | 3.8% | 1.2% | 2.5% |

Latvia | 85.6% | 6.4% | 7.2% | 0.0% | 0.7% |

Lithuania | 77.8% | 7.0% | 7.1% | 1.8% | 6.3% |

Poland | 64.5% | 21.2% | 7.3% | 1.0% | 6.0% |

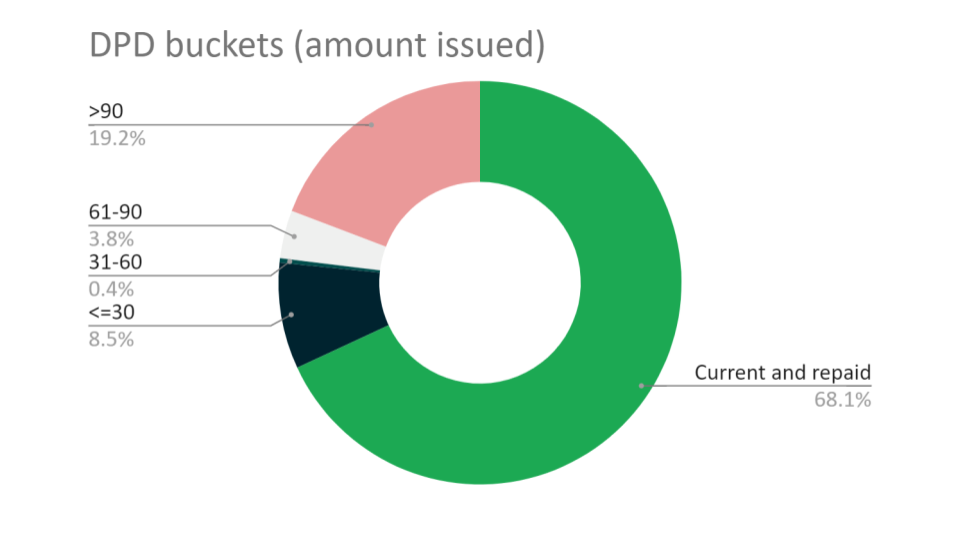

Portugal | 68.1% | 8.5% | 0.4% | 3.8% | 19.2% |

Total | 76.4% | 9.2% | 6.5% | 1.7% | 6.2% |

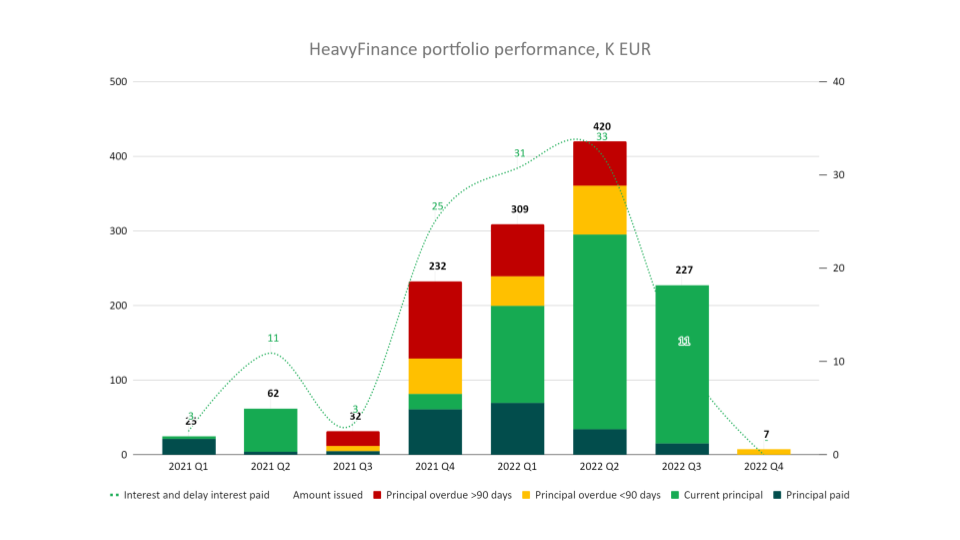

The graph below demonstrates the loan originations, principal repayments and interest payments for each quarter. For example, during Q3 of 2020, 451 thousand EUR of loans were funded, of which 431K EUR has already been repaid along with 53K EUR of interest. 11K EUR is being paid on time and 9 thousand EUR are overdue for more than 90 days. (If at least 1 instalment is overdue, we treat the whole principal amount as being late).

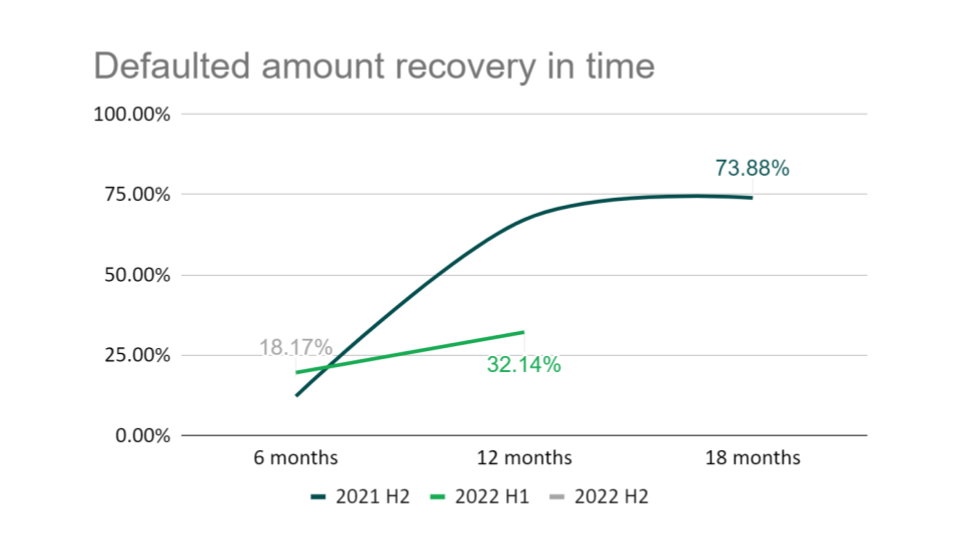

Recovery

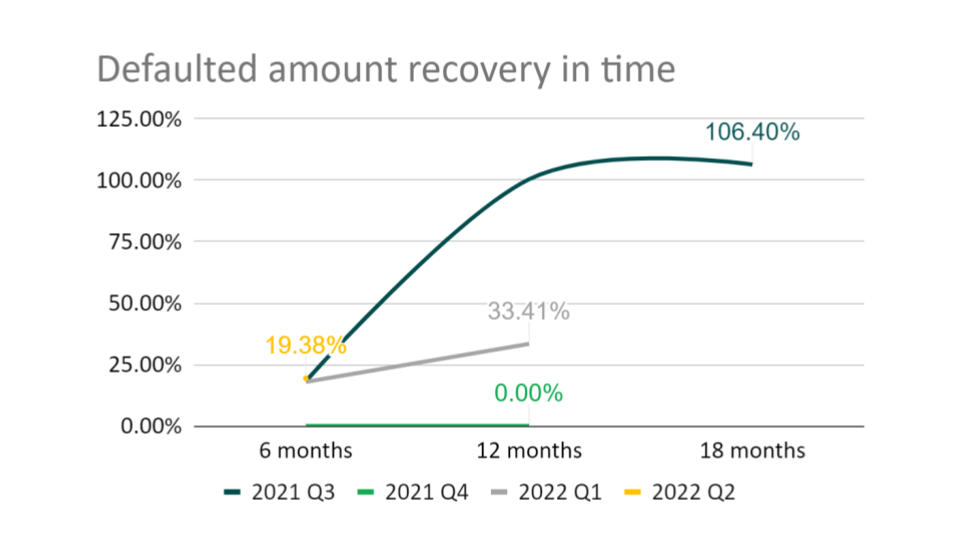

During January 2023, 108K EUR was recovered from defaulted loans and distributed to investors. A total recovered amount from defaults amounts to 987K EUR.

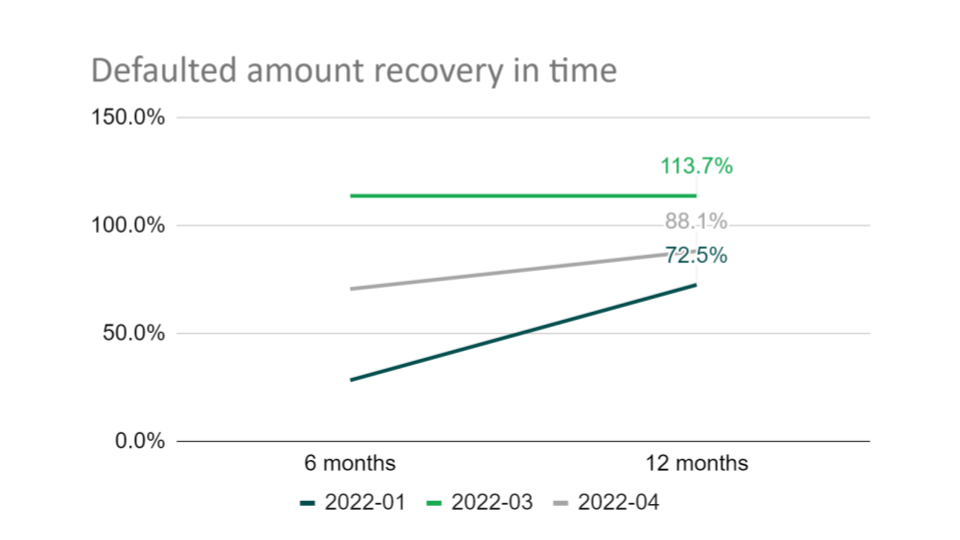

In the chart below recovery in time is presented. From the loans which defaulted in 2021 H2 HeavyFinance already recovered 73.88%.

Bulgaria

Since April 2021, 2.89M EUR of loans were issued in Bulgaria with 80% of these loans being paid on time or have been repaid already. Thus, earning investors 239K EUR of interest, with 73K EUR of principal being overdue for over 90 days.

In January alone investors received 83K EUR from Bulgarian farmers – 63K principal, 19K interest and 1K delay interest.

The distribution of delay buckets is presented below:

A total of 230K EUR has reached the point of being 90 days overdue at some stage during the life cycle. 88K EUR has already been recovered and distributed to investors. While the loans defaulted in March, 2022 are fully recovered with additional interest. 88.1% from the loans defaulted in April, 2022 have already been recovered.

Latvia

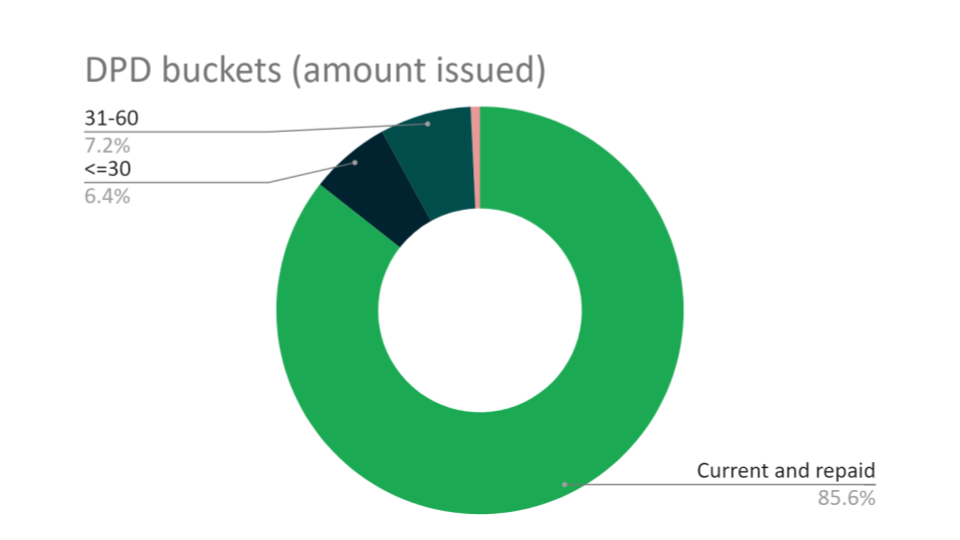

Since May 2021, 1.60M EUR of loans were issued in Latvia. 86% of loans issued are being paid on time or have been repaid already. Thus, earning investors 137K EUR of interest. 11.8K EUR of principal is being overdue for more than 90 days resulting in 0.7% from the total amount issued.

In January alone investors received 30K EUR from Latvian farmers – 19K principal, 11K interest and 69 EUR delay interest.

The distribution of delay buckets is presented below:

2 loans amounting to 11.8K EUR are overdue more than 90 days. Both are in the recovery process.

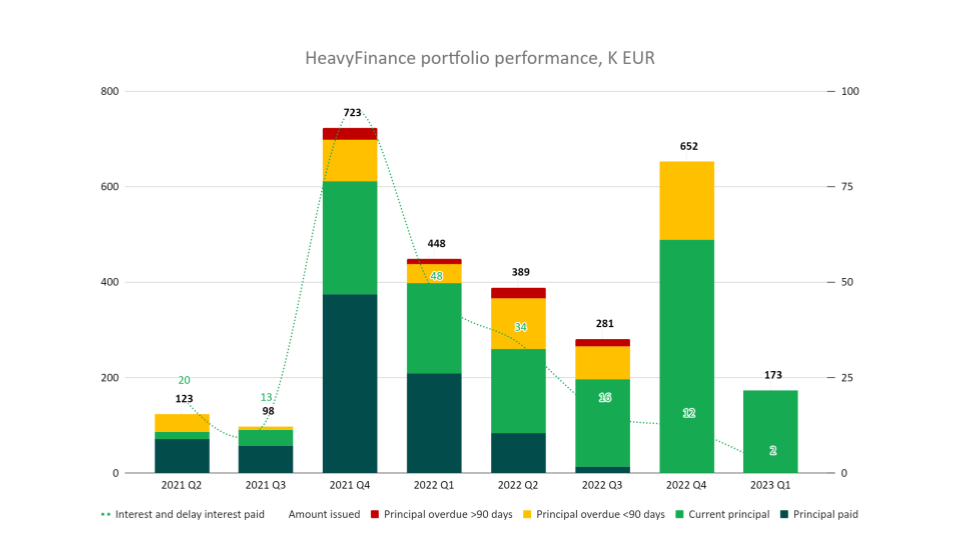

Lithuania

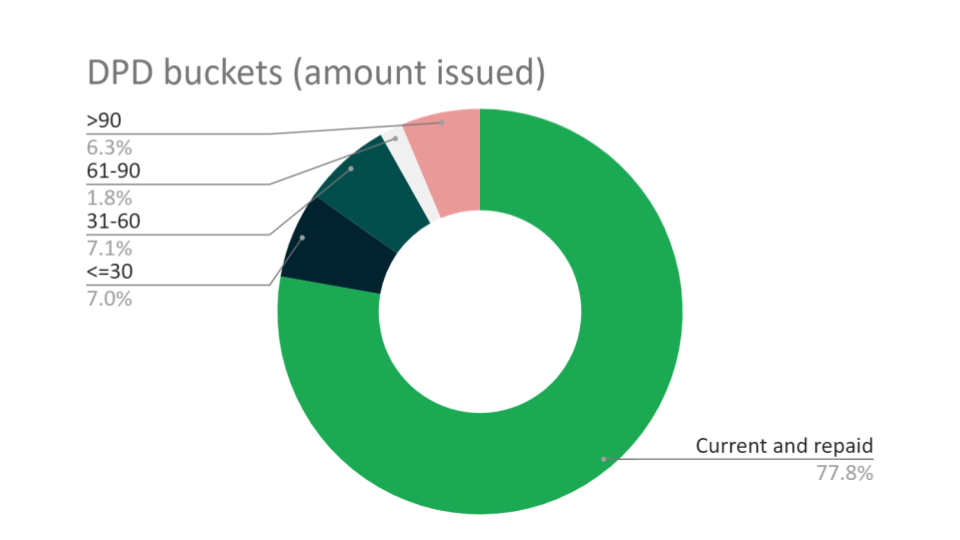

Since June 2020, 22.0M EUR worth of loans were issued in Lithuania, 78% of loans issued are being paid on time or have been repaid already. Resulting in the investors earning 2.19M EUR of interest. While 1.39M EUR has been overdue for more than 90 days.

In January alone investors received 879K EUR from Lithuanian farmers – 746K principal, 101K interest and 33K delay interest.

The distribution of delay buckets is presented below:

A total of 3.1M EUR has at some point been 90 days overdue during its lifetime. While, 880K EUR has already been recovered and distributed to investors. Furthermore, loans defaulted in 2021 Q3 are recovered in full with additional interest.

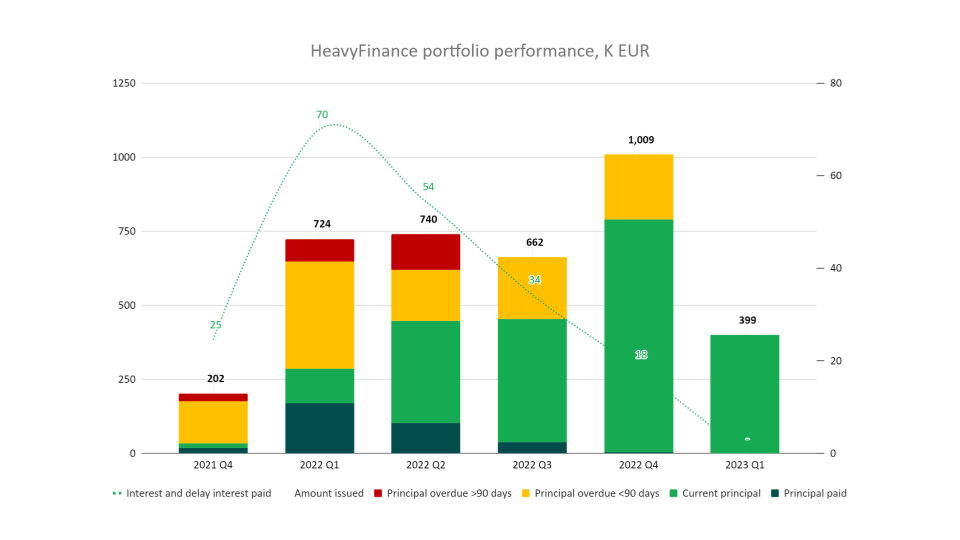

Poland

Since December 2021, 3.74M EUR of loans have been issued in Poland. 65% of those are being paid on time or have been repaid already. Thus, earning the investors 201K EUR in interest. Whereas, 225K EUR has been overdue for more than 90 days.

In January alone investors received 123K EUR from Polish farmers – 101K principal, 21K interest and 1K delay interest.

The distribution of delay buckets is presented below:

A total of 268K EUR has at one point been 90 days overdue during its lifetime. Since Poland is our newest market and all defaults are fresh – recovery takes time. At the moment 7K EUR has already been recovered and distributed to investors.

Portugal

Since December 2021, 1.31M EUR of loans have been issued in Portugal. 68% of those loans have been paid on time or have been repaid already. Thus, earning investors 115K EUR in interest. While 252K EUR has been overdue for a period of more than 90 days.

In January alone investors received 68K EUR from Portuguese farmers – 57K principal, 9K interest and 1K EUR delay interest.

The distribution of delay buckets is presented below:

A total of 268K EUR was 90 days overdue at some point during its lifetime. 12K EUR has already been recovered and distributed to investors. The recovery will begin with time as more than half of this late amount reached 90 days in Q4, 2022.

Happy investing!

HeavyFinance team