Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

In January, we saw a total of 1.47M EUR invested in agricultural projects, with 2.04M EUR being distributed across 68 different loans.

As of January 2024, HeavyFinance has successfully issued a total of 50.91 million EUR in loans. Year over year, we’re seeing a significant increase in repayment volumes, which is a positive trend for the investor community.

Our investors are seeing direct benefits of this in the form of interest with additional earnings from delayed interest. To date, the principal of 21.18M EUR has already been repaid to investors with 5M EUR in interest and 814K in delayed interest. During January our investors received 1.41M EUR in repayments – 1.15M EUR principal, 175K EUR interest, and 83K in delay interest. 1.49M EUR of repayments are scheduled for February 2024.

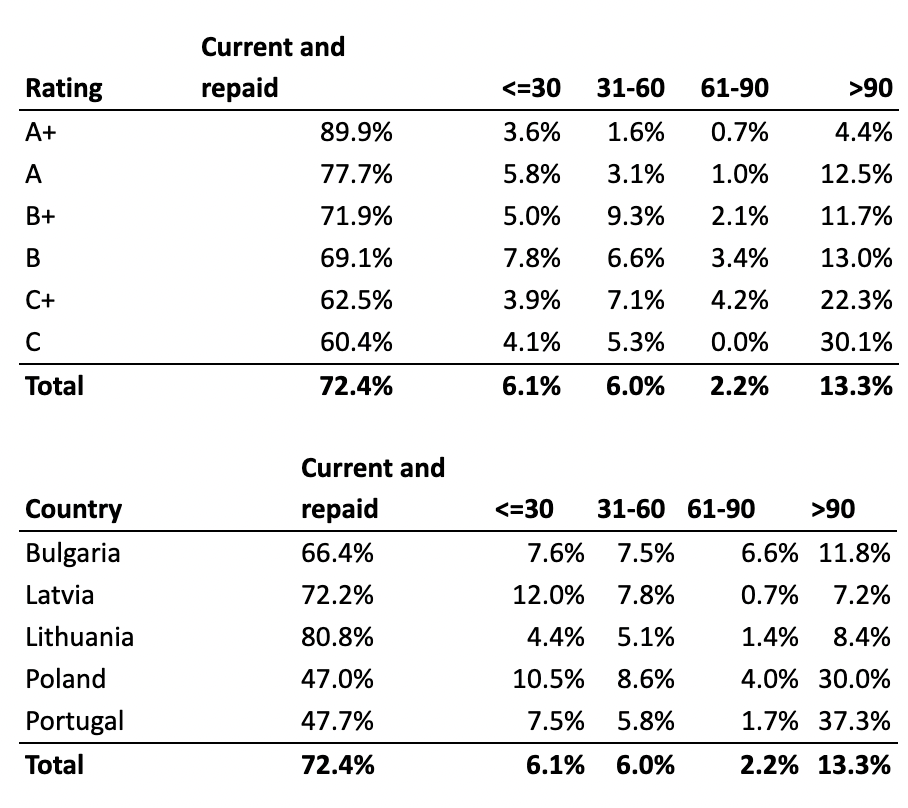

As of now, based on the repayment schedule, 72.4% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 6.76M EUR representing 13.3% of the total issued amount.

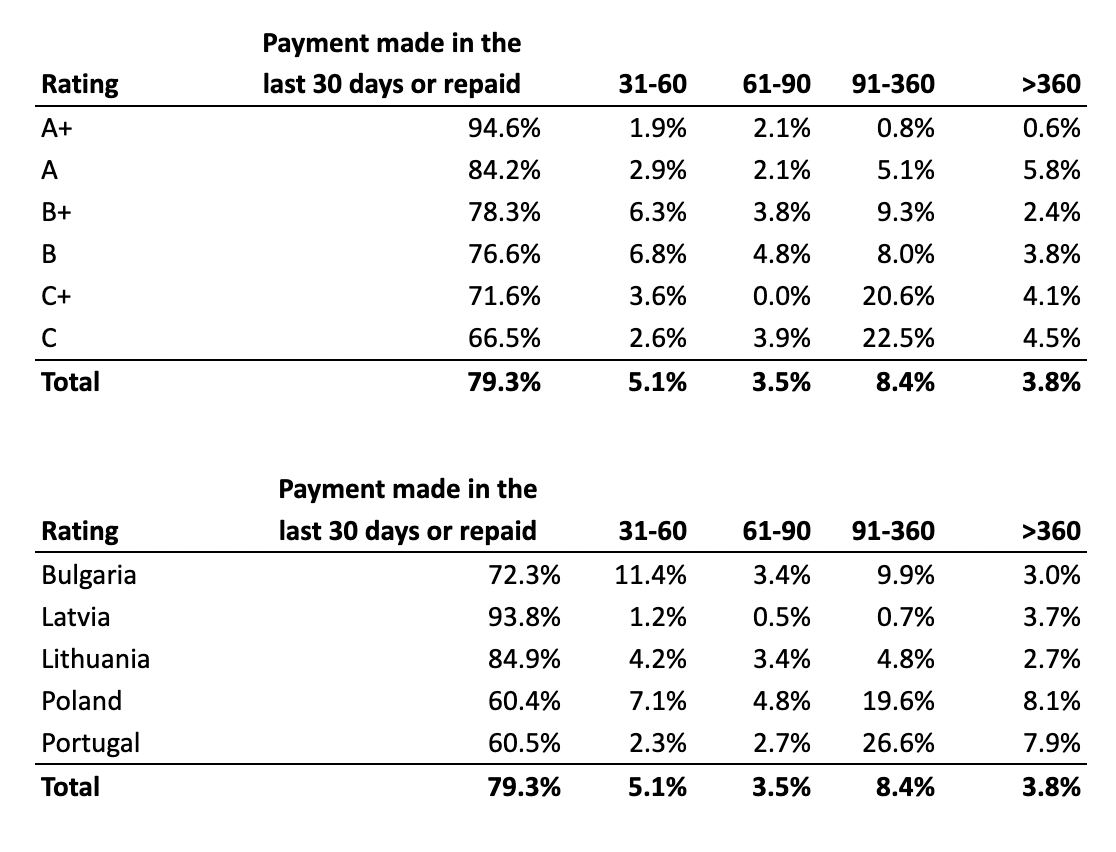

The below table demonstrates the farmers’ repayment habits in a more accurate manner by depicting loans with factual repayment delinquencies. As of now, 79.3% of the payments have either been made within the last 30 days or have already been fully settled.

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 876K EUR has already been repaid along with 186K EUR of interest. 82K EUR is being paid on time, 53K EUR is overdue for less than 90 days and 147K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

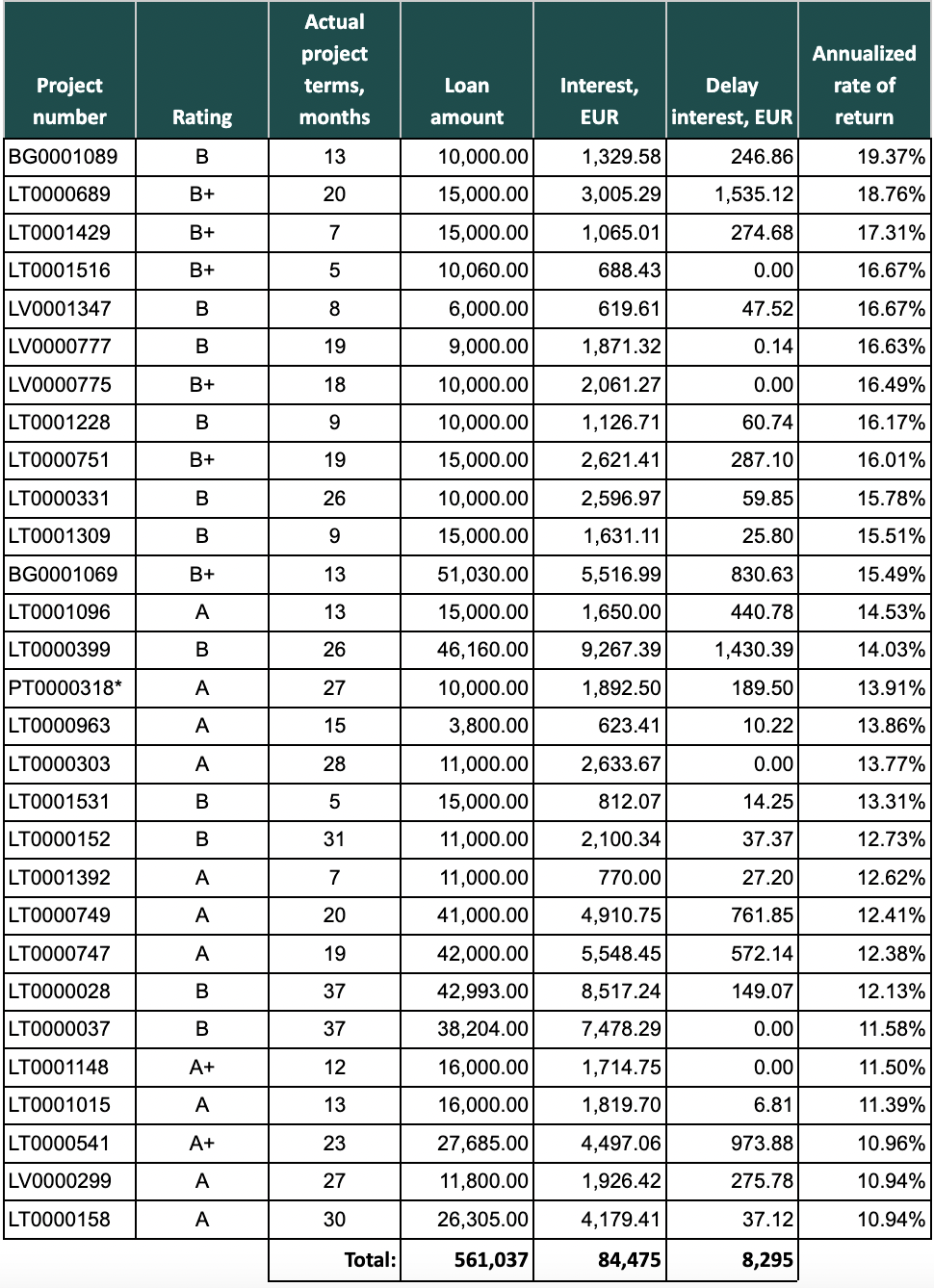

Fully repaid loans in January

In January, 29 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.66%. Notably, the factual return rate ranged from a high of 19.37% to a low of 10.94%. The total issuance for the loans amounted to 561K EUR. Investors received 84.5K EUR in interest and 8.3K EUR in delayed interest for the loans that were fully repaid during January.

*One terminated loan was fully repaid in January 2024.

PT0000318 terminated on 2023-07-04

The loan was unsecured and the borrower struggled to keep up with the payments, so HeavyFinance had to terminate the agreement. After a discussion with lawyers the borrower contacted HeavyFinance to work out a repayment plan. New plan was agreed upon to pay off the loan in six months. From July 18, 2023, to January 22, 2024, the borrower made all the agreed payments settling the debt completely.

Recovery

During January 2024, 39.9K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 1.96M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, setting a 110.35% recovery rate.

During Q4 of 2023 HeavyFinance enhanced its recovery team across Lithuania, Poland and Portugal, which is already showing an increase in recoveries. Last year proved to be difficult for farmers in terms of harvest, so financing needs are still in high demand.

Overall, last year ended on a high note but the HeavyFinance team continues to address the financing gap in agriculture. Make sure to visit our project page to put your money to work.

Happy investing!