Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

Well, that’s us halfway through the summer and July has proved to be a dynamic month for our investor community, with 1.33M EUR allocated across 52 agricultural projects on the HeavyFinance platform. By the close of July 2024, the total loan issuance since the company’s inception has reached 58.33M EUR.

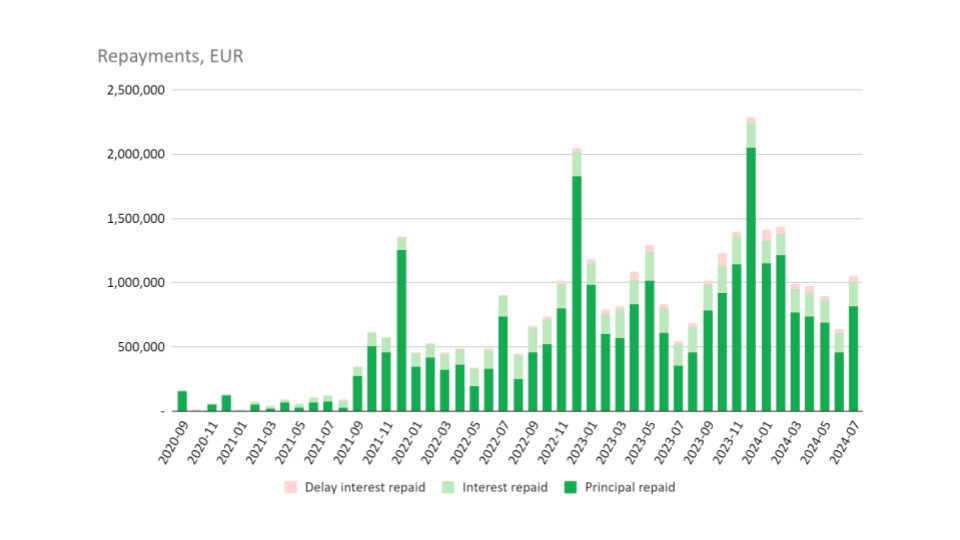

To date, the principal of 25.85M EUR has already been repaid to investors with 6.05M EUR in interest and 1.09M in delayed interest. During July our investors received 1.06M EUR in repayments – of which 819K EUR principal, 185K EUR in interest, and 52K in delay interest. 0.82M EUR of repayments are scheduled for August 2024.

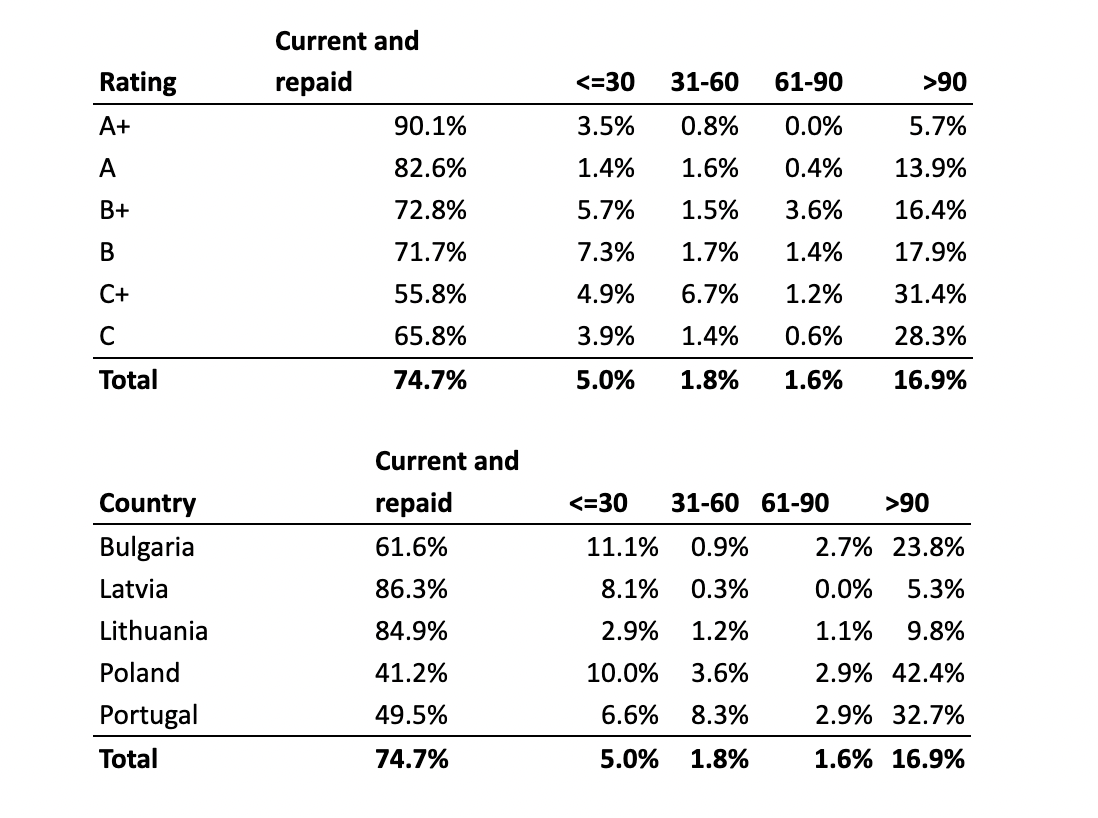

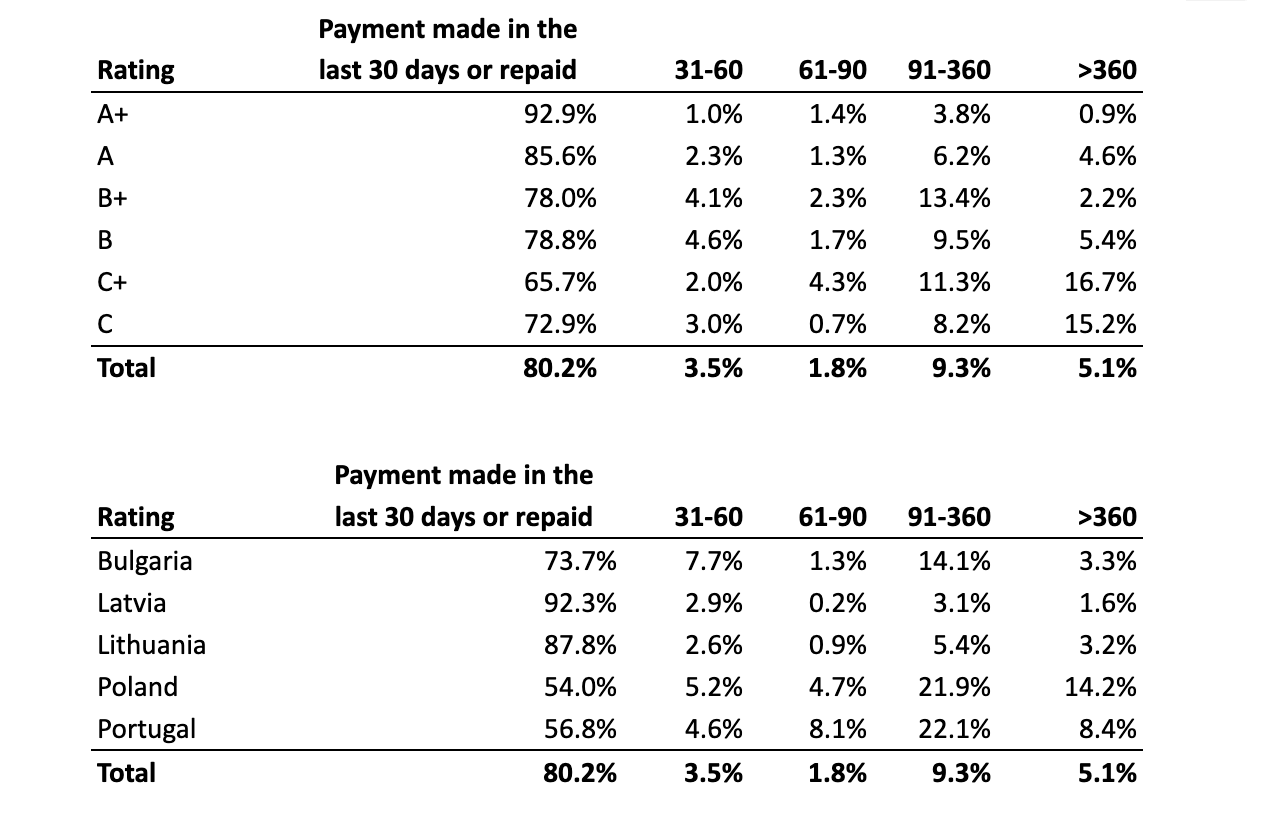

Based on the repayment schedule, 74.7% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 9.86M EUR representing 16.9% of the total issued amount.

The following table demonstrates the farmers’ repayment habits in a more detailed manner by depicting loans with factual repayment delinquencies. As of now, 80.2% of the payments have either been made within the last 30 days or have already been fully settled.

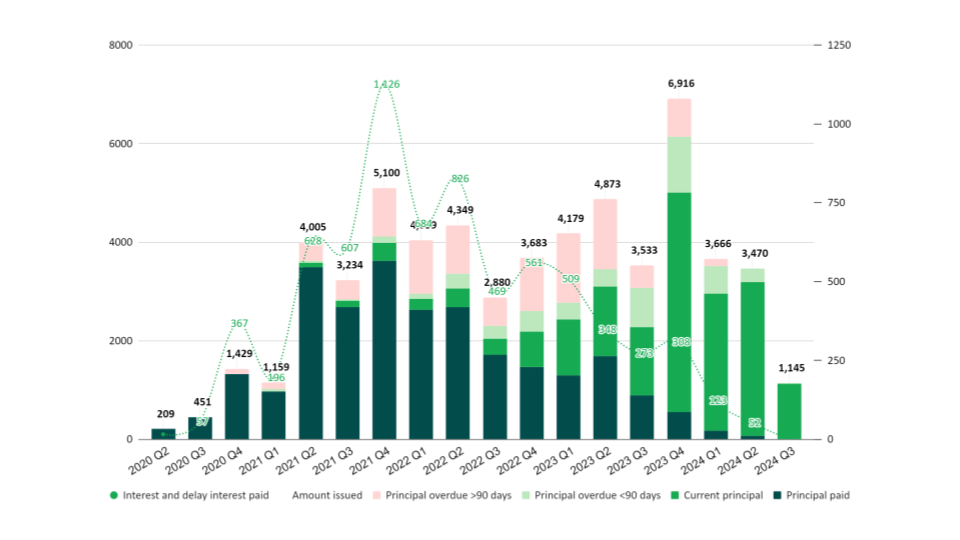

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 967K EUR has already been repaid along with 195K EUR of interest. 50K EUR is overdue for less than 90 days and 142K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

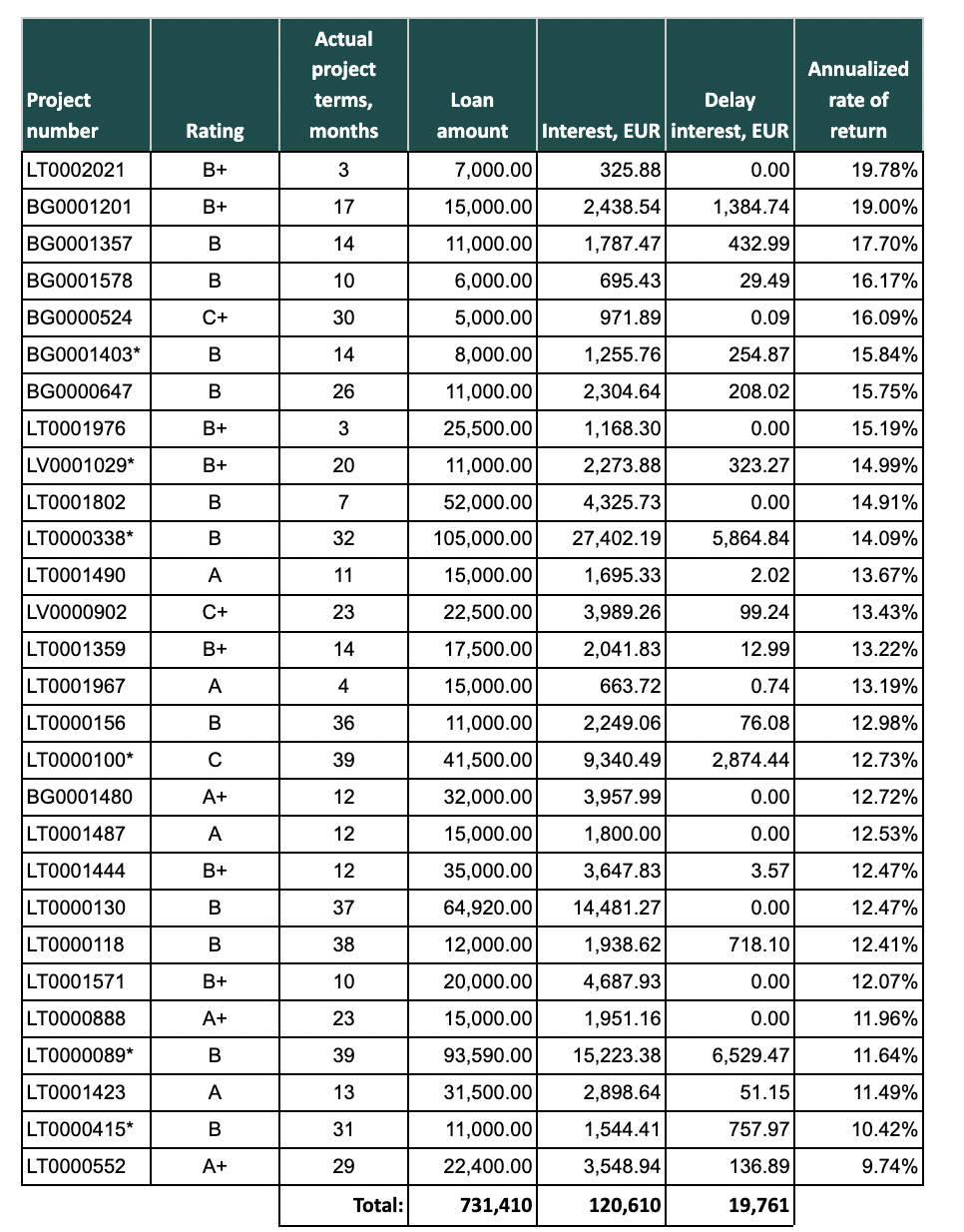

Fully repaid loans in July

In July, 28 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.27%. Notably, the factual return rate ranged from 19.78% to 9.74%. The total issuance for the loans amounted to 731K EUR. Investors received 120K EUR in interest and 20K EUR in delayed interest for the loans that were fully repaid during July.

*six terminated loans were fully repaid in July 2024.

LT0000338 Terminated on 2022-04-22 and LT0000415 Terminated on 2022-06-01

The debtor in question had two loan agreements terminated, firstly LT0000338 terminated on April 22, 2022, and then LT0000415 terminated on June 01, 2022. One of the loans was secured by pledging a piece of land, while the other loan was uncollateralized. Due to economic challenges, the debtor was unable to meet the payment obligations for both loans. On July 4, 2022, debt recovery procedures were initiated, leading to the issuance of an executive letter. The pledged land was put up for auction multiple times, but the auctions failed due to a lack of interested buyers. The debtor made partial payments over time. In response, HeavyFinance suggested that the debtor independently find a buyer for the pledged land. A buyer was eventually found, and HeavyFinance assisted in finalizing the necessary documentation. The proceeds from the sale were used to fully repay the debt, thus avoiding the need for a forced sale of the property, through proactive measures and cooperation between the debtor and HeavyFinance.

LT0000100 Terminated on 2022-03-25

The loan agreement was terminated on March 25, 2022. The loan was backed by a seeder as collateral. However, due to economic difficulties, the borrower could not meet his payment obligations. Consequently, debt recovery procedures were initiated on May 30, 2022, leading to the issuance of an executive letter. Despite these challenges, the borrower maintained active communication with HeavyFinance and made partial payments. When these payments ceased, an auction for the pledged seeder was announced. The borrower was informed and given the chance to settle the remaining debt voluntarily. In the end, the borrower paid off the remaining amount using personal funds, which allowed him to fully settle the debt. This proactive action prevented the need for a forced sale of the collateral.

LT0000089 Terminated ad 2023-03-01

The loan agreement was terminated on March 1, 2023. The loan was secured by a telescopic loader as collateral, along with a guarantee from the Agricultural Loan Guarantee Fund. Due to economic difficulties, the borrower failed to fulfill his payment obligations. Consequently, on April 13, 2023, debt recovery procedures were initiated, resulting in the issuance of an executive letter. The pledged asset was auctioned, and the sale covered most of the outstanding debt. For the remaining small balance, HeavyFinance approached the Agricultural Loan Guarantee Fund for an insurance payout. Although the review process was prolonged, requiring additional documentation, the payment was eventually approved, covering the remaining debt.

LV0001029 Terminated ad 2024-02-02

The loan agreement was terminated on February 2, 2024. This loan was uncollateralized, meaning no specific assets were pledged as security. Due to the absence of collateral, the standard debt recovery process was implemented to ensure repayment. The process of the overdue collection began in January 2024 with several phone calls and the issuance of a warning letter to the borrower. Despite these efforts, the borrower failed to meet payment obligations. In February 2024, a claim was filed in court. By April 2024, the court rendered a decision, leading to discussions with the borrower. Following the court’s decision, an executive act was issued in June 2024. No voluntary payment attempts were made by the borrower, necessitating further action. In July 2024, the bailiff initiated debt recovery procedures. The bailiff successfully recovered the owed amount from the borrower, concluding the debt recovery process. The standard legal procedures, including court intervention and bailiff enforcement, led to the successful recovery of the debt, even in the absence of collateral.

BG0001403 Terminated on 2023-12-18

The loan agreement was terminated on December 18, 2023. This loan did not have any collateral, meaning there were no specific assets securing the loan. The debtor tried to avoid the debt recovery process by hiding, which prevented us from delivering the required notices. Following the court’s decision, the bailiff was prompt and efficient in his duties, conducting a thorough investigation into the debtor’s financial and property status. It was discovered that the debtor did own property, and the bailiff acted quickly to recover the debt. The debt was successfully recovered thanks to the bailiff’s effectiveness and the favorable court ruling, despite the lack of collateral and the debtor’s attempts to evade payment.

Recovery

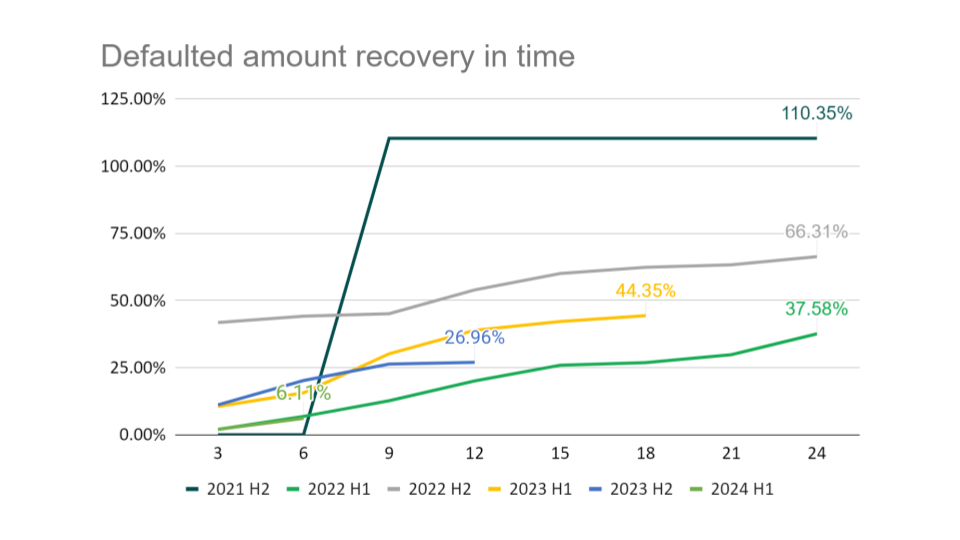

During July 2024, 254.6K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 2.73M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, resulting in a 110.35% recovery rate.

With the wheat harvest now complete in most regions, many farmers are holding back on selling due to low prices, hoping for an increase. This period typically sees a rise in loan applications as farmers seek to maximize their profits by delaying sales. Simultaneously, for those who aren’t storing their crops, this is the time when sales occur, leading to the settlement of more loans.

This week also marks the beginning of planting for the 2025 season, with crops like rapeseed being sown. As farmers plan for the future, they may require additional financing for their investments. Additionally, the Polish Ministry of Agriculture is expected to offer extra financial support to farmers due to the current low wheat prices—a move likely influenced by the upcoming presidential elections.

A quick reminder: a few months ago, we updated our platform to include an estimation of the CO2 emissions being addressed in our projects to inform our investors of the impact they’re making on the environment. Additionally, for those interested in our Green Loans, we have launched a newsletter that covers monthly updates of the carbon credit market, and updates concerning our Carbon Farming Projects.

Make sure to visit our project page to make your investment count.

Happy investing!

HeavyFinance team