Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

June proved to be a dynamic month for our investor community, with 1.16M EUR allocated across 36 agricultural projects on the HeavyFinance platform. By the close of June 2024, the total loan issuance since our company’s inception has reached 56.90M EUR.

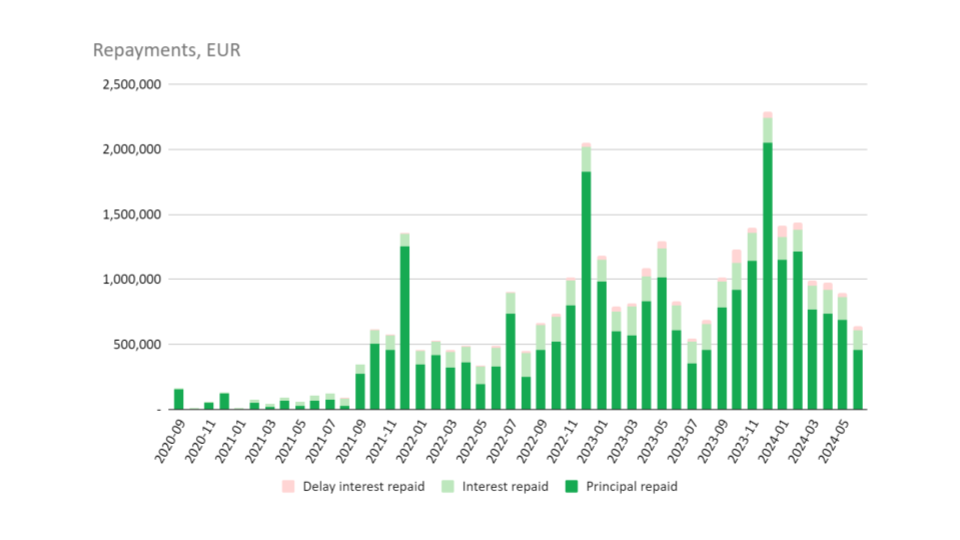

To date, the principal of 25.03M EUR has already been repaid to investors with 5.86M EUR in interest and 1.04M in delayed interest. During June our investors received 641K EUR in repayments – of which 456K EUR principal, 149K EUR in interest, and 37K in delay interest. 790K EUR of repayments are scheduled for July 2024.

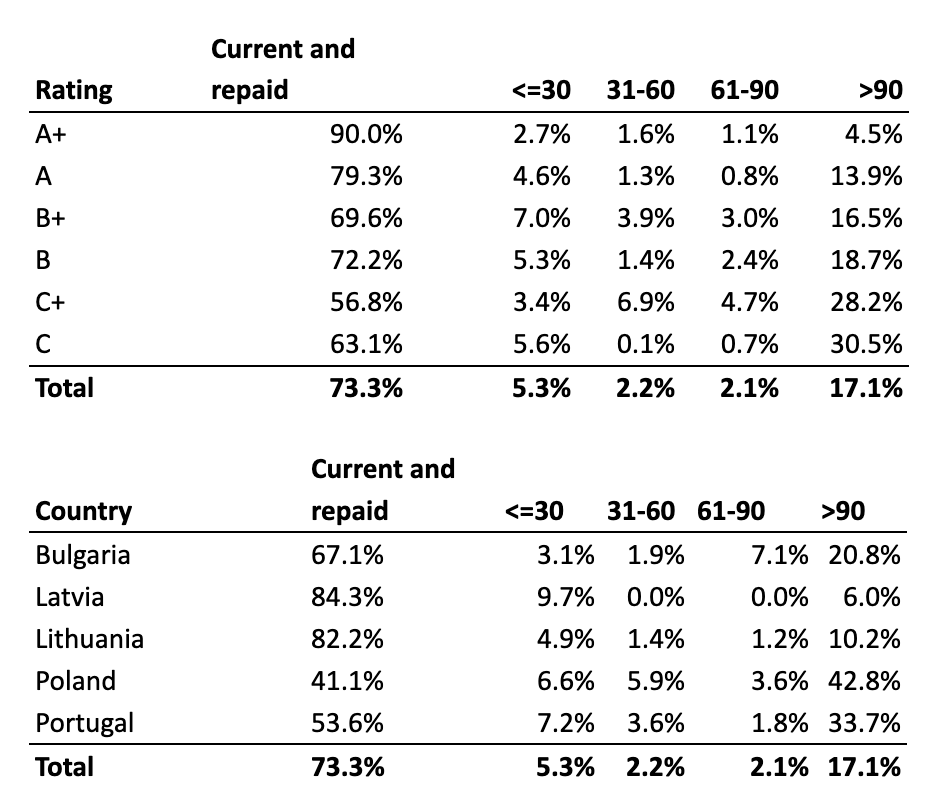

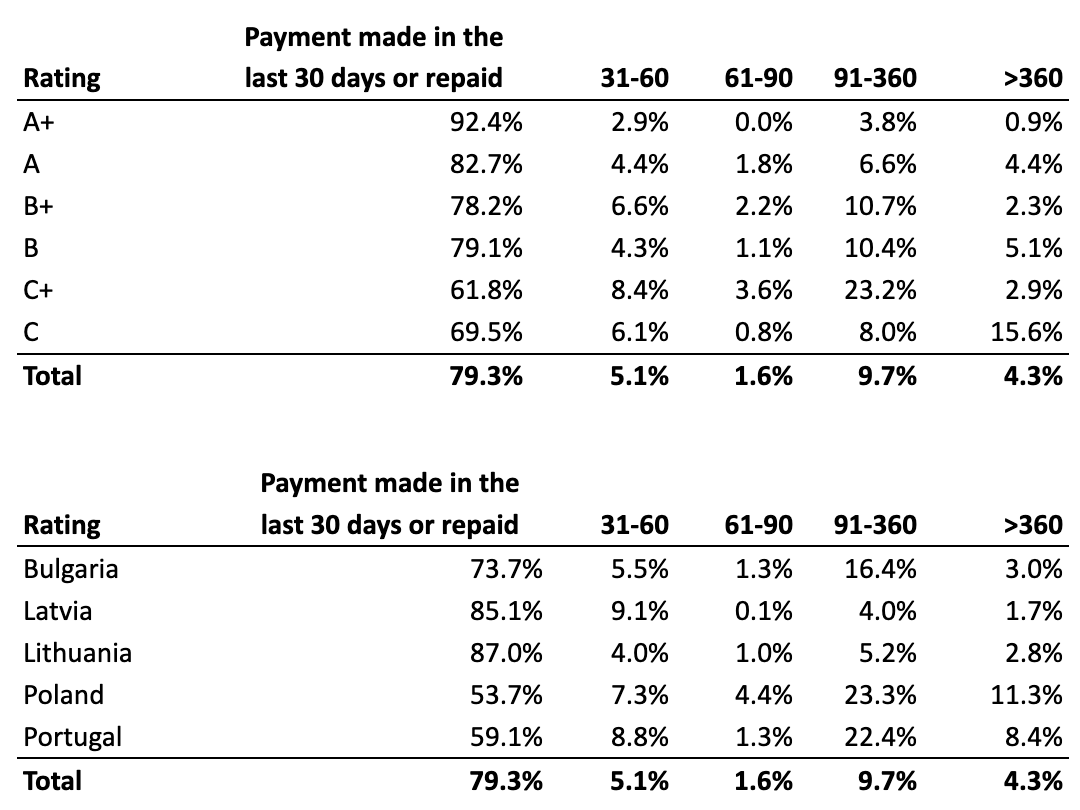

Based on the repayment schedule, 73.3% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 9.76M EUR representing 17.1% of the total issued amount.

The below table demonstrates the farmers’ repayment habits in a more accurate manner by depicting loans with factual repayment delinquencies. As of now, 79.3% of the payments have either been made within the last 30 days or have already been fully settled.

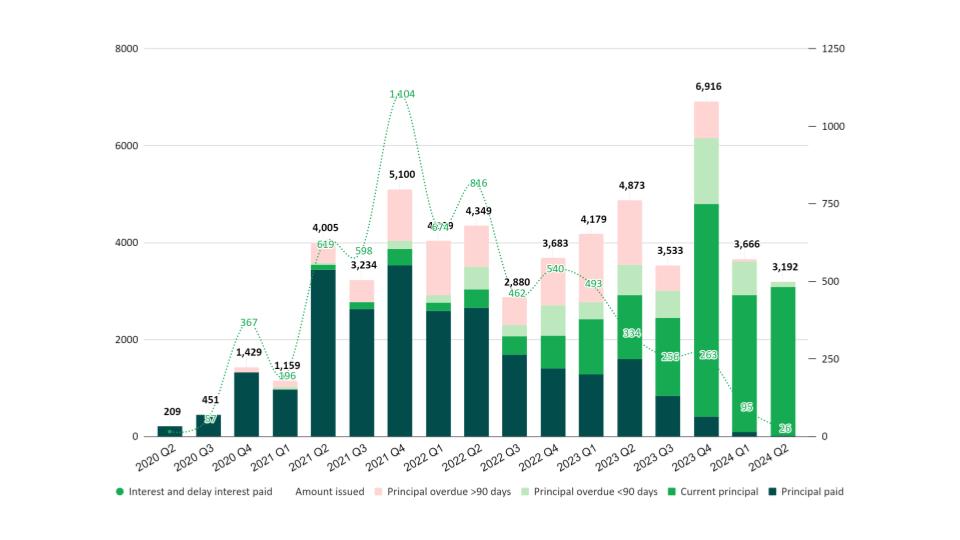

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 967K EUR has already been repaid along with 195K EUR of interest. 0K EUR is being paid on time, 50K EUR is overdue for less than 90 days and 142K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

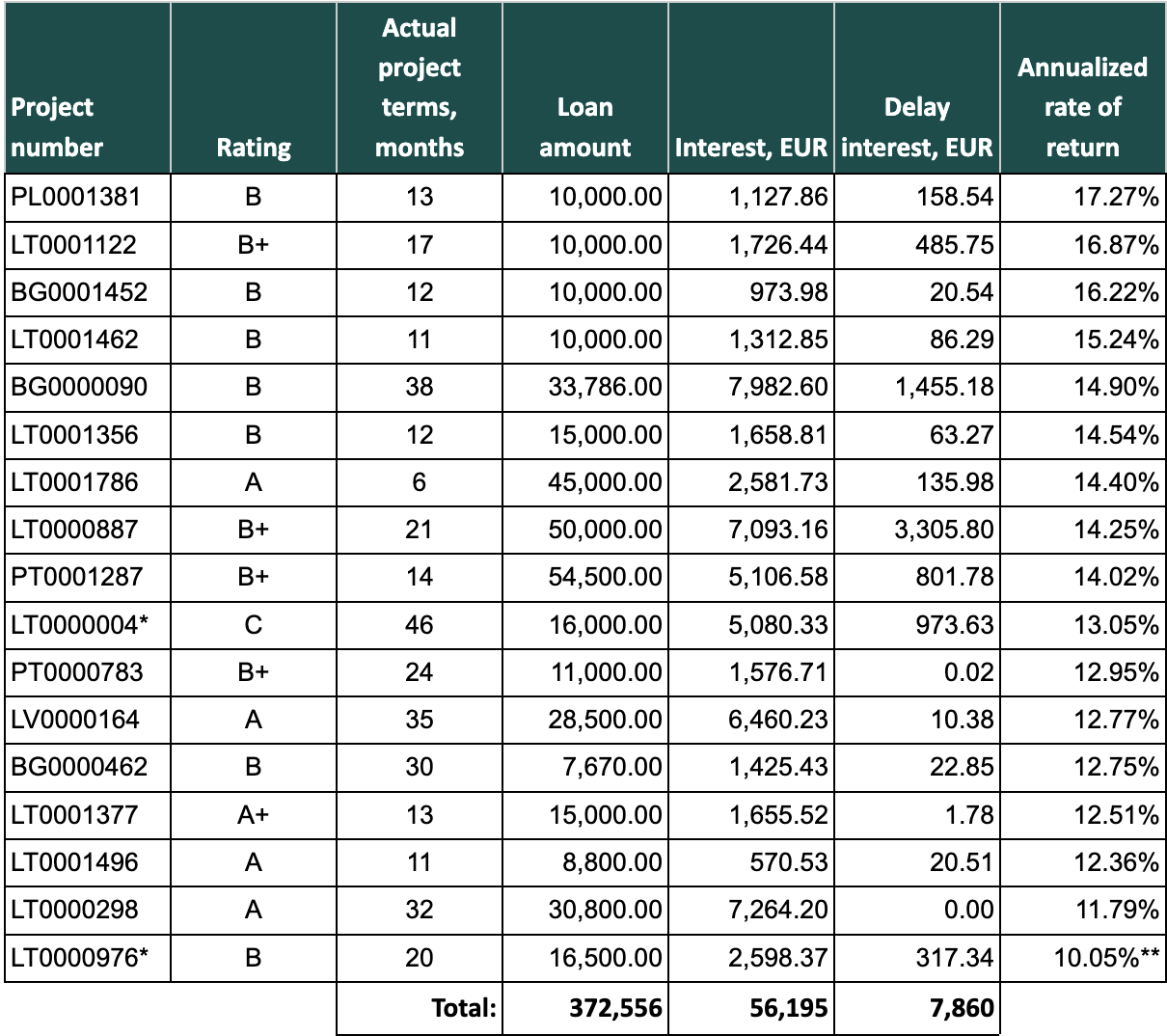

Fully repaid loans in June

In June, 17 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.80%. Notably, the factual return rate ranged from 17.27% to 10.05%. The total issuance for the loans amounted to 373K EUR. Investors received 56K EUR in interest and 8K EUR in delayed interest for the loans that were fully repaid during June.

*two terminated loans were fully repaid in June 2024.

LT000004 terminated on 2023-07-31

The loan agreement was terminated on July 31, 2023. The borrower struggled to meet payment obligations due to economic difficulties. In response to these defaults, debt recovery procedures commenced on September 12, 2023, resulting in the issuance of an executive letter. The debtor, while maintaining active communication with HeavyFinance, made partial payments towards the debt. When a small amount remained unpaid, the payments ceased, prompting the initiation of an auction for the pledged tractors. The debtor was informed of the auction and given a final opportunity to settle the debt. The debtor paid the remaining amount using personal funds, fully settling the debt. This proactive resolution prevented the need for a forced sale of the pledged assets. The debt was successfully resolved through the debtor’s efforts, avoiding the forced sale of collateral.

LT0000976 terminated on 2023-05-29

The loan agreement was terminated on May 29, 2023. This loan was secured by pledging a seeder as collateral. The borrower failed to meet payment obligations due to economic difficulties. Debt recovery procedures began on June 30, 2023, with the issuance of an executive letter. The collateral was repeatedly put up for auction, but the auctions failed due to the lack of buyers. Given the declining auction prices, HeavyFinance opted to negotiate with the borrower to settle the debt through other means. Initially, the debtor intended to repay the debt from the 2024 harvest. However, HeavyFinance did not agree to this extended timeline, and the borrower ultimately settled the debt by borrowing funds. This resolution avoided selling the collateral at a price lower than the debt amount. The debt was resolved without the need for a forced sale, preserving the collateral’s value.

**However, procedural interest remains to be settled, which will increase the return for investors.

Recovery

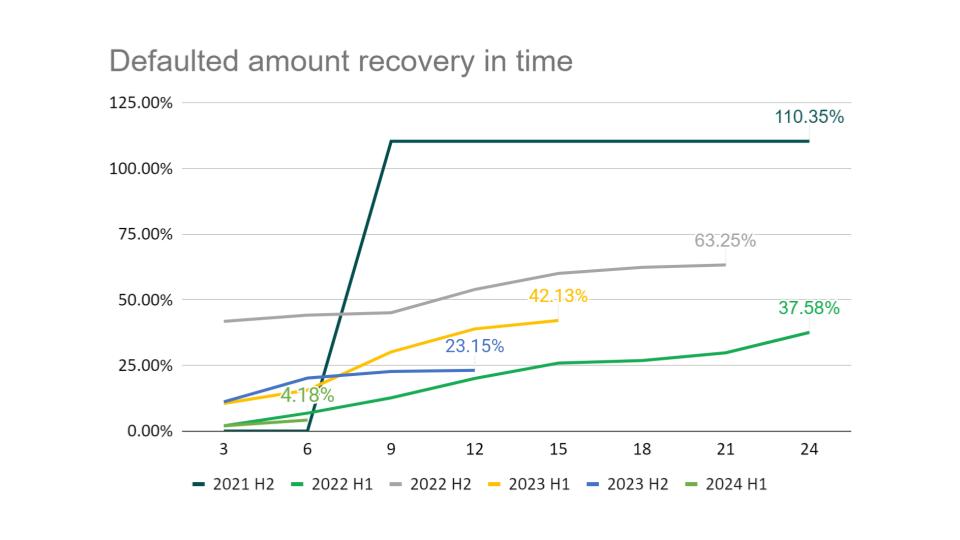

During June 2024, 84.1K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 2.47M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, resulting in a 110.35% recovery rate.

Right now, the agriculture sector is fully back in the swing with some farmers already harvesting the crop, others preparing to follow up in the upcoming weeks, therefore the demand currently being for small working capital loans rather than for large collateralised ones.

Feedback indicates that this year’s harvest is of better quality and quantity compared to last year. As a result, we expect an increased inflow of loan repayments in the upcoming months, as well as a quicker recovery process for defaulted farmers.

In other news, recently we have updated our platform to include an estimation of the CO2 emissions being addressed in our projects to inform our investors of the impact they’re making on the environment. Furthermore, for those interested in our Green Loans, we have launched a newsletter that covers monthly updates of the carbon credit market, this issue includes the latest selling prices for carbon credits generated through agriculture.

Make sure to visit our project page to put your money to work.

Happy investing!

HeavyFinance team