Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

In March, a total of 843K EUR was invested and distributed across 29 agricultural projects available on the HeavyFinance platform. As of the end of March 2024, a significant sum of 53.42 million EUR was issued in loans since the inception of HeavyFinance.

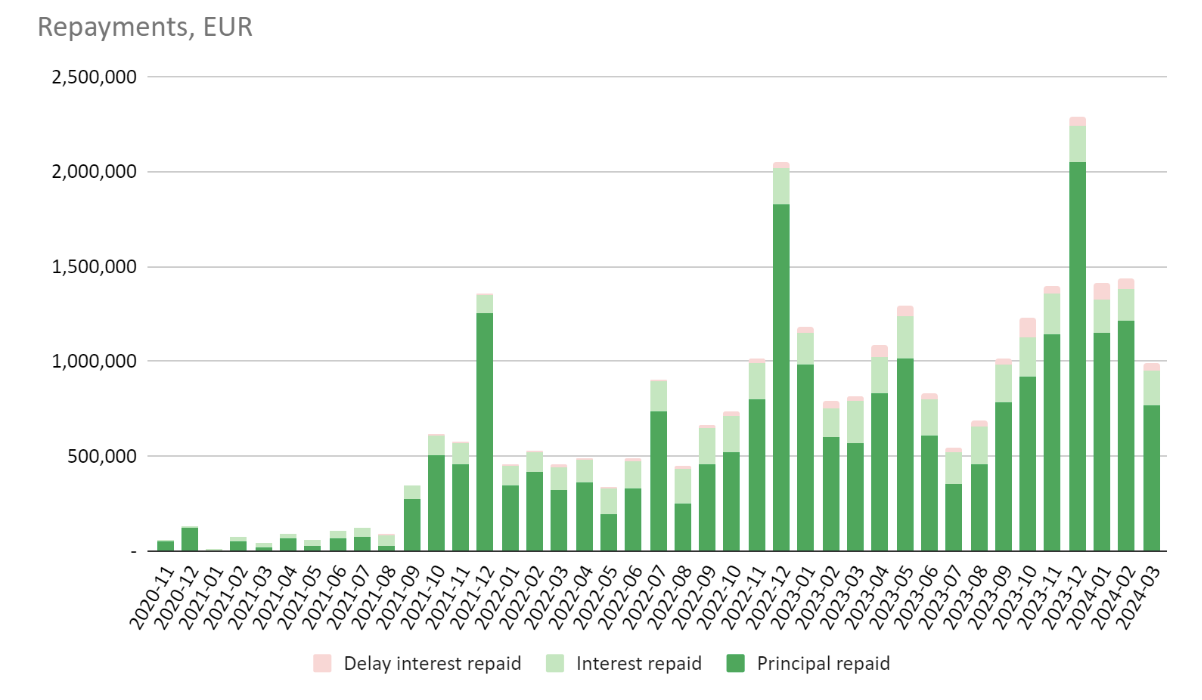

A positive trend worthy of mentioning is that year over year, we’re seeing a significant increase in repayment volumes. Our investors are seeing direct benefits of this in the form of interest with additional earnings from delayed interest.

To date, the principal of 23.15M EUR has already been repaid to investors with 5.36M EUR in interest and 918K in delayed interest. During March our investors received 993K EUR in repayments – of which 764K EUR principal, 187K EUR in interest, and 42K in delay interest. 993K EUR of repayments are scheduled for April 2024.

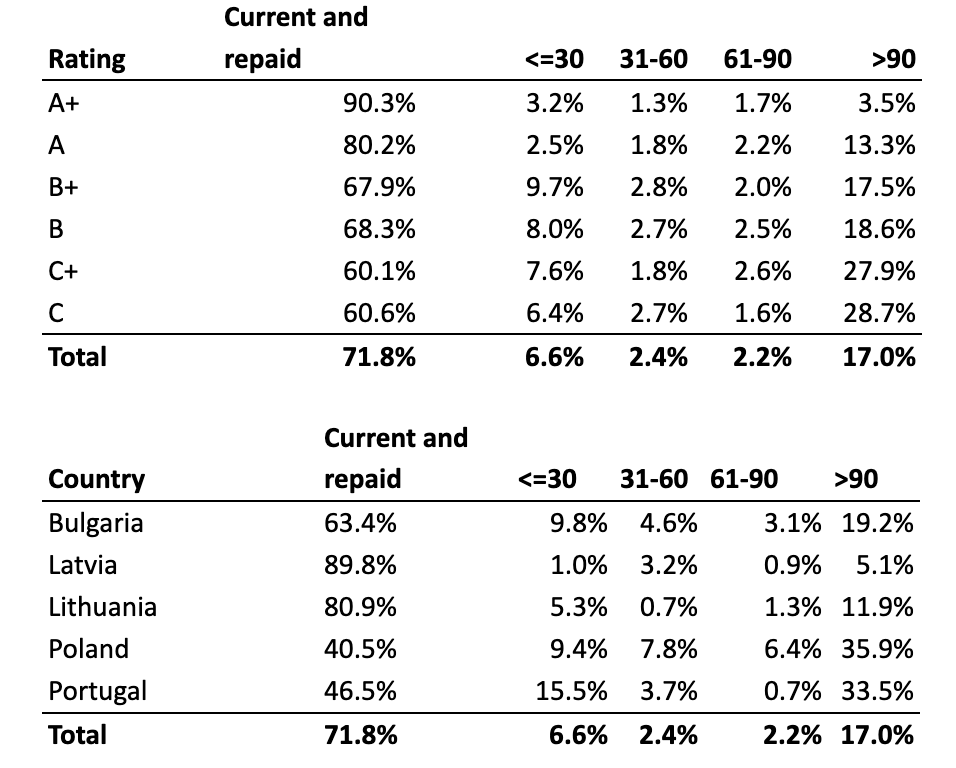

As of now, based on the repayment schedule, 71.8% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 9.09M EUR representing 17.0% of the total issued amount. The increase in delinquencies is seasonal and is expected to decrease in May and June when farmers will get the part of their yearly subsidies.

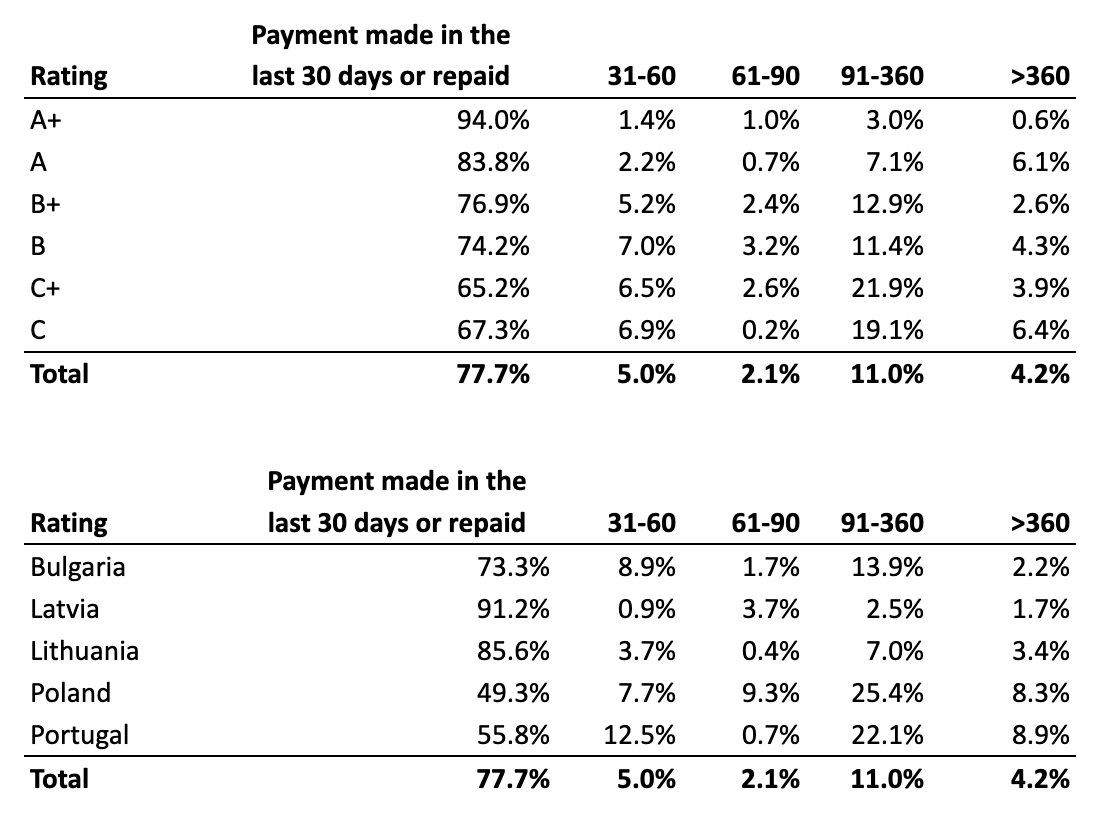

The below table demonstrates the farmers’ repayment habits in a more accurate manner by depicting loans with factual repayment delinquencies. As of now, 77.7% of the payments have either been made within the last 30 days or have already been fully settled.

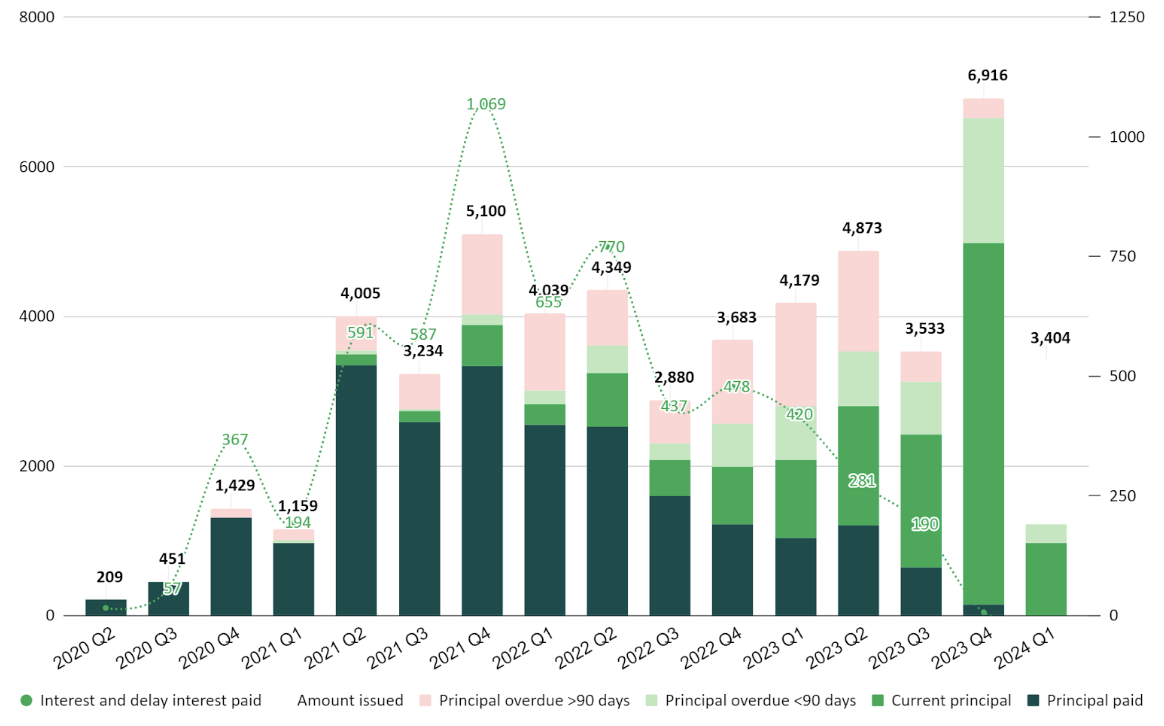

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 876K EUR has already been repaid along with 186K EUR of interest. 82K EUR is being paid on time, 53K EUR is overdue for less than 90 days and 147K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

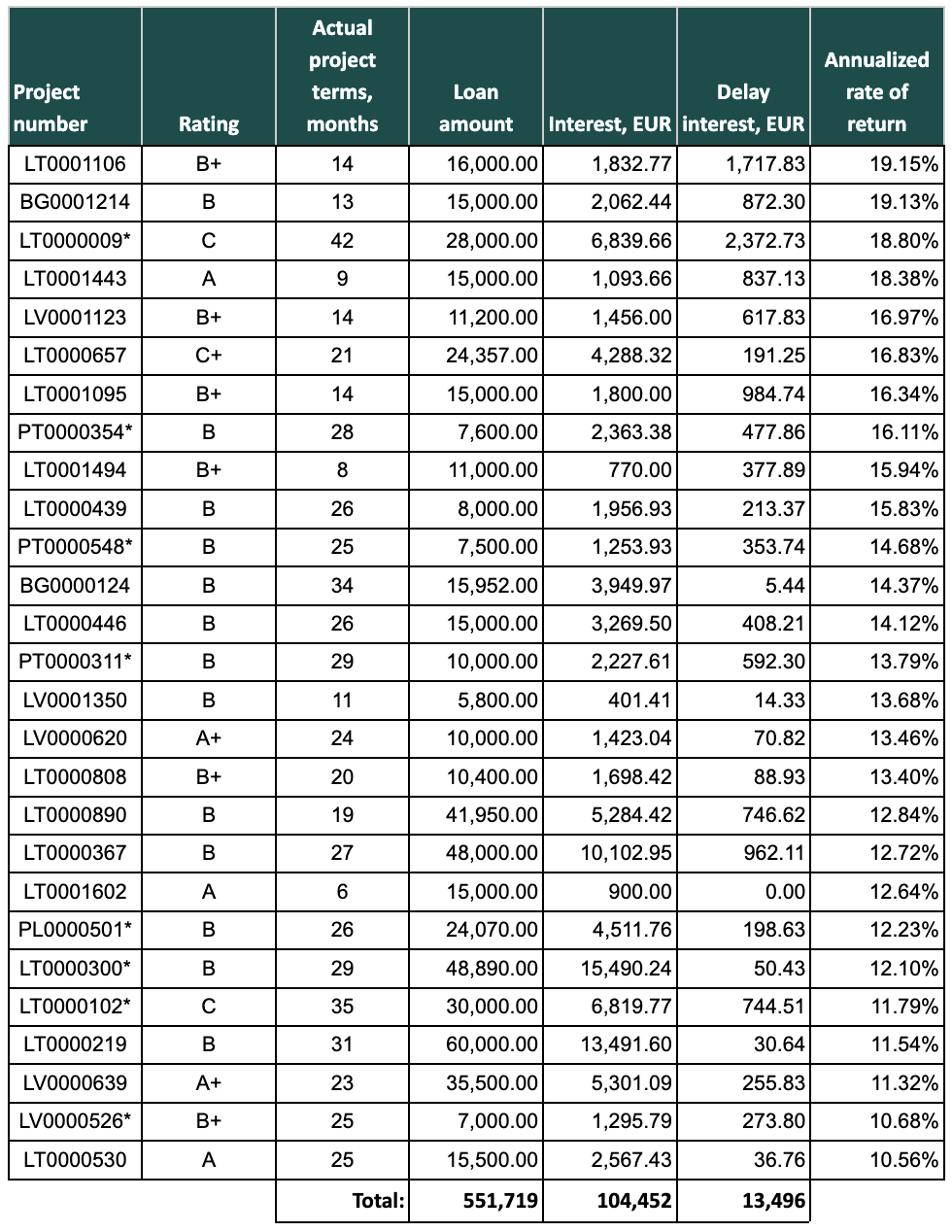

Fully repaid loans in March

In March, 27 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.81%. Notably, the factual return rate ranged from 19.15% to 10.56%. The total issuance for the loans amounted to 552K EUR. Investors received 104K EUR in interest and 13.5K EUR in delayed interest for the loans that were fully repaid during March.

*Eight terminated loans were fully repaid in March 2024.

LT0000009 terminated on 2021-09-19

The loan agreement was secured with forestry equipment. It was terminated in September, 2021 due to the borrower’s failure to meet payment obligations, attributed to economic challenges and other factors. The debtor was in communication and was making partial payments, but subsequently, debt recovery proceedings were initiated on November 29, 2022, caused by the issuance of an executive letter. Despite this, the borrower, engaging in active communication with HeavyFinance, settled the entire debt using personal funds. This proactive resolution prevented the need for forced property sales.

LT0000102 terminated on 2022-04-14

The loan agreement established on April 23, 2021, was secured with a disc harrow. However, due to challenging economic circumstances and natural disasters damaging the farmer’s fields, sufficient revenue could not be secured to meet the obligations. Consequently, as the borrower failed to fulfill the agreed-upon terms, we terminated the agreement and initiated debt recovery proceedings. On June 1, 2022, an executive letter was obtained, which we submitted to the bailiff for execution. It’s important to note that the borrower maintained active communication with HeavyFinance throughout the process and managed to cover the entire loan, including any outstanding amounts, using personal funds. This proactive approach enabled the debtor to retain the equipment without resorting to forced sales.

LT0000300 terminated on 2022-03-29

The loan agreement was established on October 6, 2021, and secured with heavy equipment, specifically a tractor, and sole accountability of the borrower. The borrower encountered financial difficulties that led to payment delays and default. HeavyFinance requested the bailiff to take custody of the equipment pledged to HeavyFinance by the borrower. The bailiff complied with HeavyFinance’s request and informed the borrower that the equipment would be taken into custody. The borrower contested the bailiff’s decision, claiming that there were funds in the bank account that could partially cover the debt owed to HeavyFinance. In the usual debt recovery process, funds cannot be debited from the account until the pledged assets are realized, but based on the information provided in the borrower’s appeal, the bailiff debited funds from the account and transferred them to HeavyFinance between March 14-16, 2024 to fully cover the outstanding amount.

LV0000526 terminated on 2023-01-12

The loan agreement was initiated on January 25, 2022, and was secured with the personal surety of the owner of the company. The borrower encountered financial difficulties that prevented timely payments, leading to default. In response to the borrower’s payment failures, HeavyFinance terminated the loan agreement. Documents were submitted to the court on January 12, 2023, followed by the issuance of a writ of execution on March 24, 2023. The debt was then sent to the bailiff. Despite the challenges, the recovery process was successful, and the outstanding amount was fully recovered and paid to investors.

PL0000501 terminated on 2022-06-13

The loan agreement initiated on 2022-01-27 was secured with heavy machinery. The borrower encountered financial difficulties that led to payment delays or defaults. Following the termination of the loan agreement, documents were submitted to court on August 10, 2022. Subsequently, an enforcement order was issued, and the debt was transferred to a bailiff on January 24, 2023. The legal process involved the submission of documents to court and the issuance of an enforcement order. The bailiff initiated the debt recovery process and debited payments from the borrower’s account between February 8, 2023, and March 27, 2024. These payments were used to satisfy the investor’s interests and fully repay the loan. The debt collection process successfully recovered payments from the borrower, satisfying both the investor’s interests and fully repaying the loan.

PT0000354 terminated on 2023-05-24

The loan initiated on November 15, 2021, was secured with the personal surety of the company’s director and her husband. Due to the difficulty of collecting de payments during the contract validity and after several months with overdue installments, on May 24, 2023, the creditor HeavyFinance proceeded with the termination of the contract loan. On September 20, 2023, HeavyFinance started a pre-judicial action against the borrower and the guarantors to obtain an enforcement order that allowed the repossession of assets. This enforcement order was obtained on December 12, 2023. During January the collections & recoveries Portugal team tried to collect the overdue balance, but the debtor never showed real commitment to pay the debt. On February 9, 2024, HeavyFinance started a judicial action supported by the enforcement order obtained on December 12, 2023, and HeavyFinance started to pawn the borrower and the guarantor’s assets. On March 8, 2024, the debtor successfully covered the remaining debt. No assets were sold during the recovery process, all the payments were voluntary and the judicial action was terminated.

PT0000311 terminated on 2023-05-02

The loan initiated on October 10, 2021, was secured with the personal surety of the company’s director. Due to the difficulty of collecting de payments during the contract validity and after several months with overdue installments, on May 2, 2023 the creditor HeavyFinance proceeded with the termination of the loan contract. On September 12, 2023, HeavyFinance started a pre-judicial action against the borrower and the guarantors to obtain an enforcement order that allows the repossession of assets. This enforcement order was obtained on November 15, 2023. During January the collections & recoveries Portugal team tried to collect the overdue balance, but the debtor never showed real commitment to pay the debt. On January 21, 2024, HeavyFinance started a judicial action supported by the enforcement order obtained on November 15, 2023. Followed by pawning the borrower’s and the guarantor’s assets. On March 18, 2024, the debtors successfully covered the remaining debt. No assets were sold during the recovery process, all the payments were voluntary and the judicial action was terminated.

PT0000548 terminated on 2024-02-15

The loan agreement, initiated on February 20, 2022, secured with the personal surety of the borrower. During the contract validity, the debtor paid installments on time till the last installment which was paid only partially. The HeavyFinance collections & recoveries team contacted the debtor to collect the overdue installment, but the debtor only paid 2.500 €. After this payment the debtor never answered the phone again and didn’t reply to SMS or emails regarding the overdue amount. On January 31, 2024, the creditor HeavyFinance sent a letter to the debtor with the information to cover the debt within 5 days otherwise, HavyFinance will start a judicial action. HeavyFinance never had an answer from the debtor, so on February 21, 2024, the HeavyFinance collections & recoveries team started a judicial action based on the signed contract, followed by pawning one asset of the debtor. HeavyFinance managed to recover the amount to satisfy the overdue amount from the judicial action.

Recovery

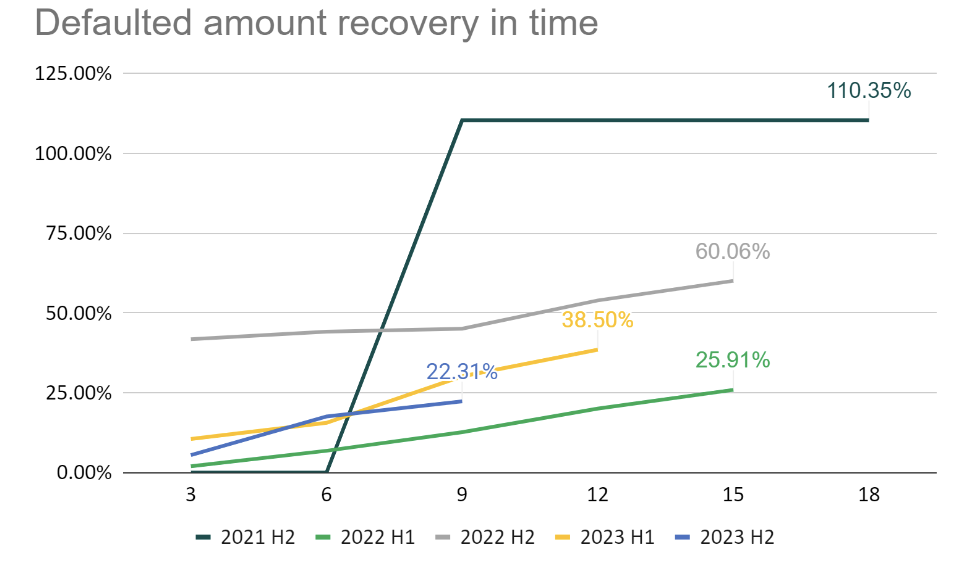

During March 2024, 266.6K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 2.28M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, resulting in a 110.35% recovery rate.

The agricultural sector is notably susceptible to seasonal fluctuations. Despite facing challenges, particularly evident in Poland during the previous year, farmers are actively strategizing to fulfill their commitments and establish mutually beneficial solutions with the investor community of HeavyFinance.

Overall, last year ended on a high note but the HeavyFinance team continues to address the financing gap in agriculture. Make sure to visit our project page to put your money to work.

Happy investing!