Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

In November, HeavyFinance saw a strong inflow of investments, with a total of 1.98 million EUR committed. Meanwhile, 68 agricultural projects, amounting to 2.02 million EUR, were successfully paid out to farmers. With this latest activity, our total loan issuance since inception has reached 64.04 million EUR.

To date, farmers have successfully repaid 31.20 million EUR in principal to our investors, along with 6.79 million EUR in interest and 1.30 million EUR in delayed interest. In November alone, investors received 1.64 million EUR in repayments, including 1.42M EUR in principal, 179K EUR in interest, and 47K EUR in delayed interest. Looking ahead, 3.87 million EUR in repayments are scheduled for December 2024.

Based on the repayment schedule, 76.5% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 9.57M EUR representing 14.9% of the total issued amount.

The following table demonstrates the farmers’ repayment habits in a more detailed manner by depicting loans with factual repayment delinquencies. As of now, 79.8% of the payments have either been made within the last 30 days or have already been fully settled.

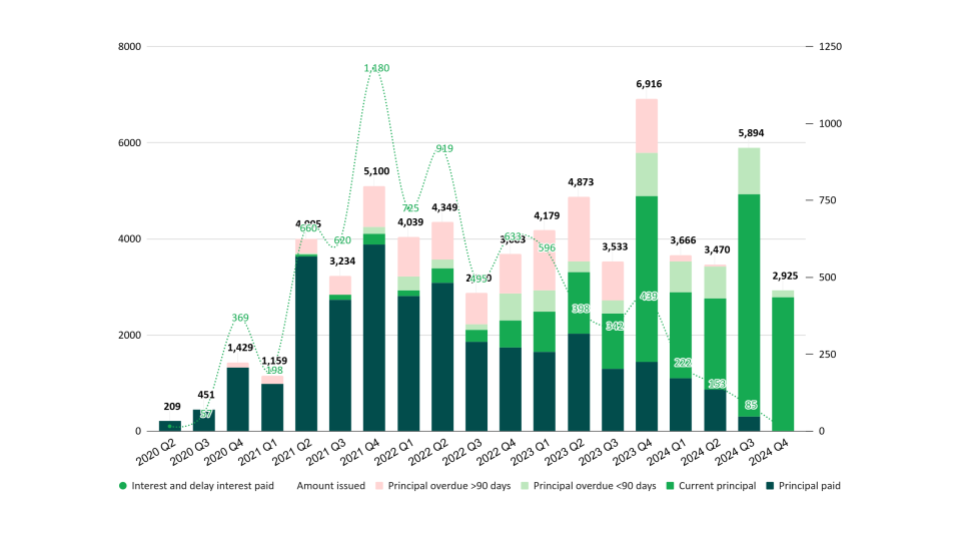

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q2 of 2021, 4.01M EUR of loans were funded, of which 3.60M EUR has already been repaid along with 660K EUR of interest. 32K EUR is overdue for less than 90 days and 305K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

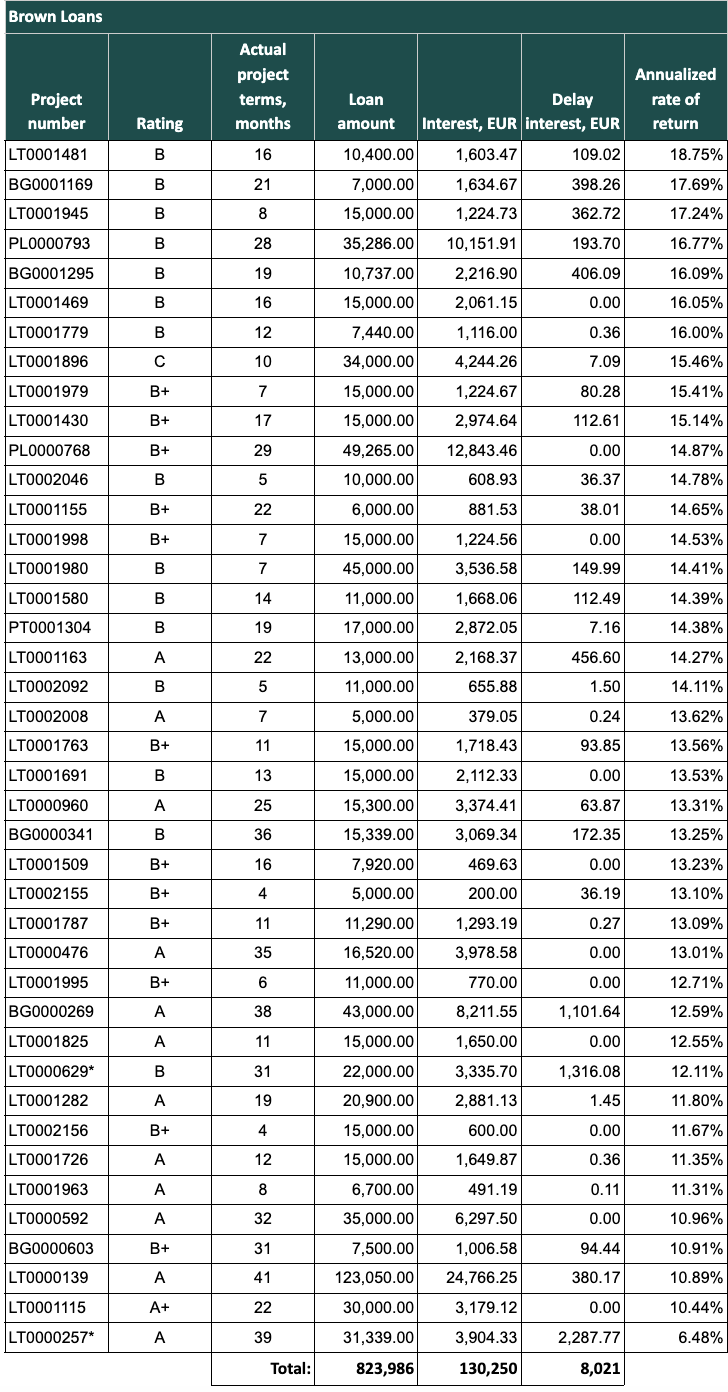

Fully repaid loans in November

In November, 41 loans were fully repaid to the HeavyFinance investors, which generated an average factual return rate of 13.11%. Notably, the factual return rate ranged from 18.75% to 6.48%. The total issuance for the loans amounted to 824K EUR. Investors received 130K EUR in interest and 8K EUR in delayed interest for the loans that were fully repaid during November.

*two terminated loans were fully repaid in November 2024.

LT0000629 Terminated on 2023-09-13

The loan agreement was secured by livestock. Due to financial difficulties, the borrower could not make the required payments. On September 13, 2023, debt recovery proceedings were started, and a bailiff was assigned to collect the debt.

To avoid a long and complicated recovery process, HeavyFinance offered the borrower a chance to repay the debt using personal funds. The borrower agreed, as their financial situation had improved, and started making partial payments. While the bailiff continued the enforcement process, the borrower paid off the remaining debt in full with personal funds.

This solution avoided the need to sell the collateral and resolved the debt successfully.

LT0000257 Terminated on 2022-03-29

The loan agreement was secured by the pledge of a seeder. Due to financial difficulties, the borrower failed to meet their payment obligations. As a result, on March 29, 2022, debt recovery proceedings began, and a writ of execution was issued.

The pledged equipment was repeatedly put up for auction, but no buyers participated. HeavyFinance requested the bailiff several times to seize the pledged equipment for safekeeping. Meanwhile, the borrower submitted complaints about the bailiff’s actions, likely delaying the recovery process. Eventually, the borrower requested that the outstanding debt be deducted from funds in their bank account. The remaining debt was fully settled using the funds in the account, concluding the case.

Recovery

During November 2024, 129.3K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 3.48M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 Q3 is recovered in full with interest, resulting in a 110.35% recovery rate.

We’d like to remind those interested in our Green Loans that we have launched a newsletter that covers monthly updates of the carbon credit market, interviews with our carbon farmers, and updates concerning our Carbon Farming Projects.

Make sure to visit our project page to make your investment count.

Happy investing!

HeavyFinance team