Welcome to the HeavyFinance performance review! You can access our previous reviews on our blog or our statistics page.

In September, investors invested a total of 1.55M EUR in agricultural projects through HeavyFinance. 881K EUR was paid out for the farmers with the capital spread across 38 different loans.

In total, 42.66M EUR was issued to the farmers until the end of September 2023. The repayment volume is increasing on a YOY basis and the HeavyFinance investor community is being rewarded in the form of interest and delay interest. To date, the principal of 15.91M EUR has already been repaid to investors with 4.21M EUR in interest and 547K in delayed interest. During September our investors received 1M EUR in repayments – 786K EUR principal, 198K EUR interest, and 32K in delay interest. 918K EUR of repayments are scheduled for October.

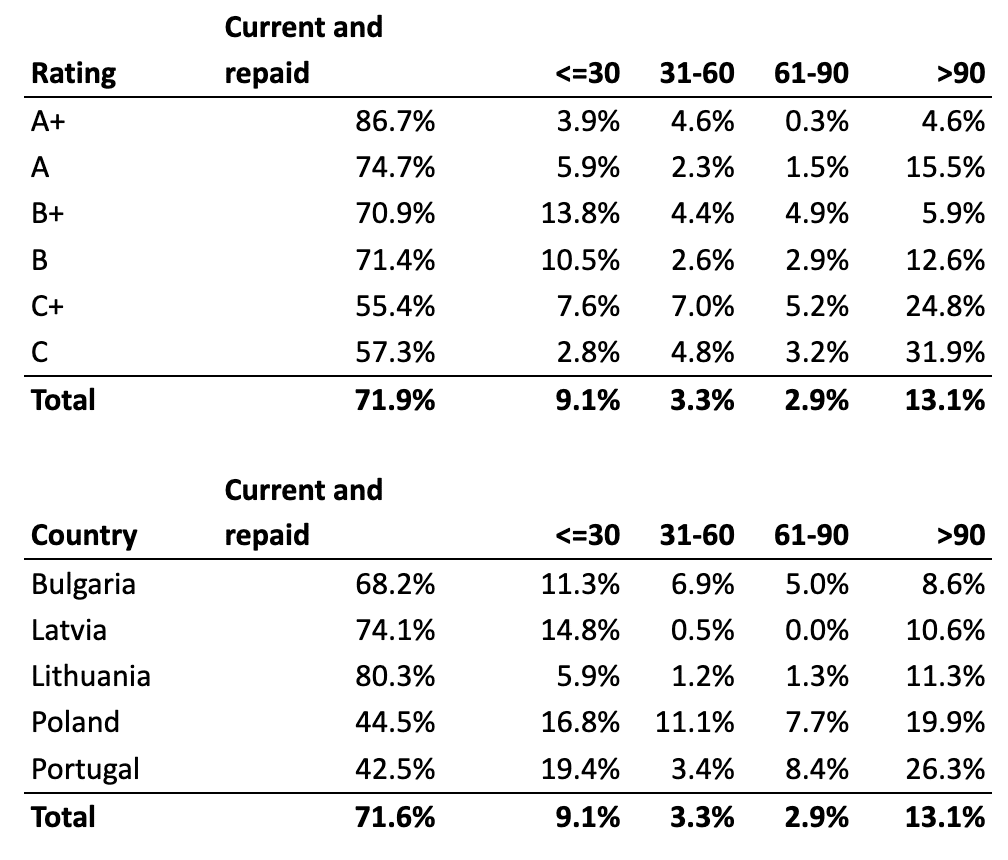

As of now, based on the repayment schedule, 71.9% of loans are being paid on time or have already been repaid. Meanwhile, loans with a principal overdue by more than 90 days amount to 5.58M EUR representing 13.1% of the total issued amount.

For a more accurate view of farmers’ repayment habits, the HeavyFinance team prepared a table depicting loans with factual repayment delinquencies. As of now, 78.6% of the payments have either been made within the last 30 days or have already been fully settled.

The graph below demonstrates the loan originations, principal repayments, and interest payments for each quarter according to the repayment schedules. For example, during Q1 of 2021, 1.16M EUR of loans were funded, of which 876K EUR has already been repaid along with 186K EUR of interest. 82K EUR is being paid on time, 53K EUR is overdue for less than 90 days and 147K EUR is overdue for over 90 days. (If at least 1 installment is overdue, we treat the whole principal amount as being late).

Fully repaid loans in September

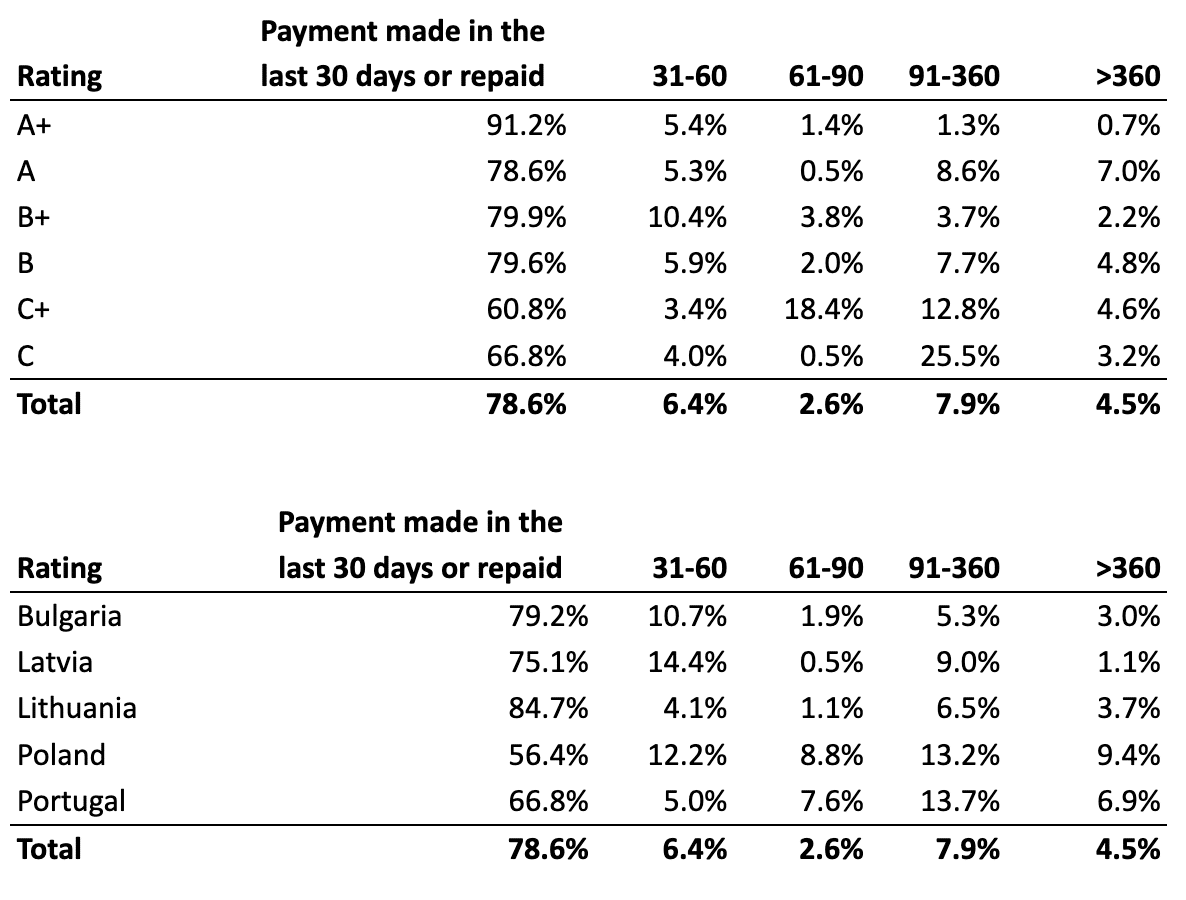

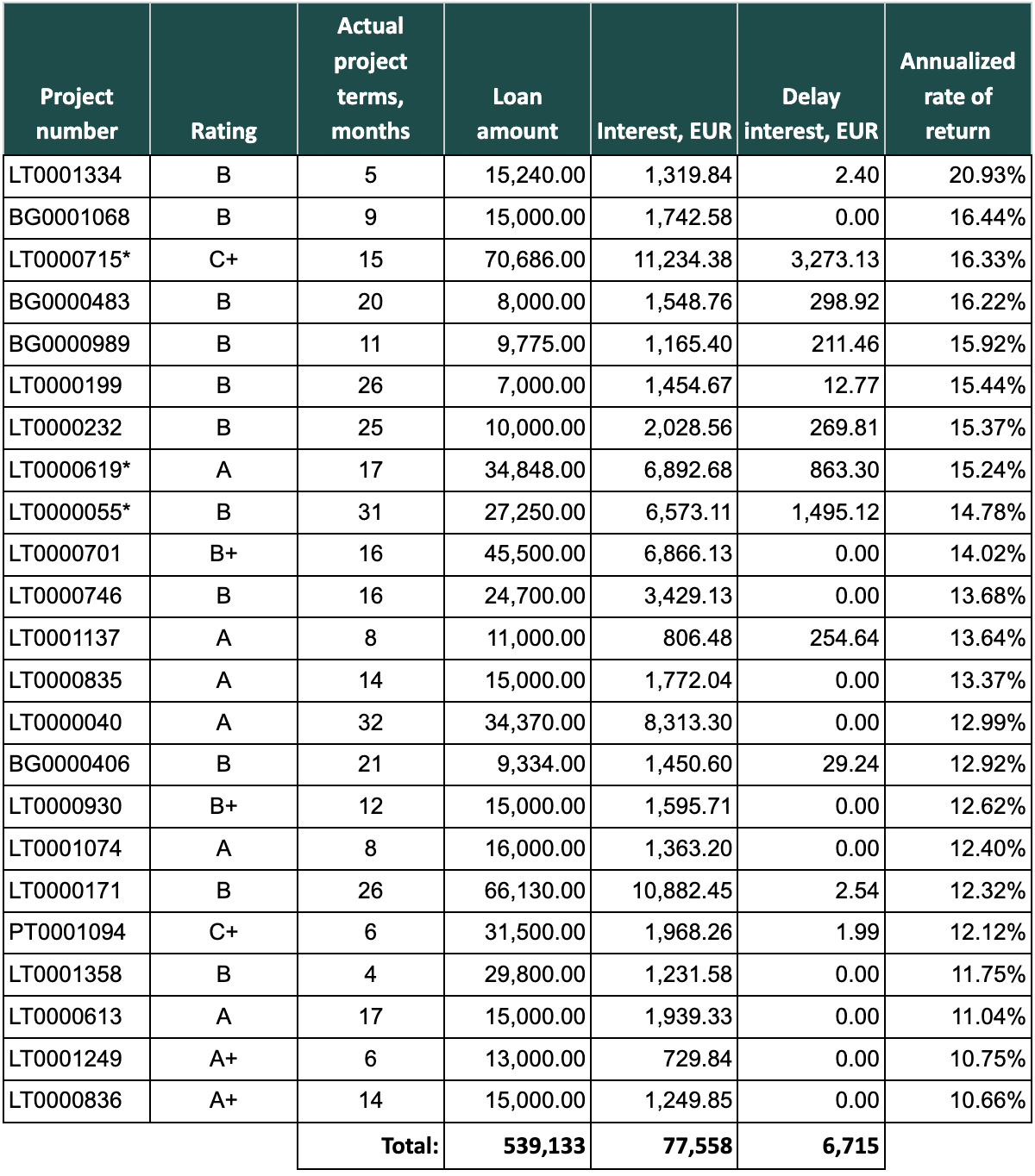

During September, 23 loans were fully repaid to the HeavyFinance investors. The loans listed below generated an average of 13.90% factual return rate. The highest return rate reached 20.93% while the lowest return rate was 10.66%. A total amount of 539K EUR was issued, with 78K EUR interest and 6K EUR delay interest received by investors for the fully repaid loans in September.

*Three terminated loans were fully repaid in September 2023.

LT0000619 Terminated on 2023-03-15

The loan agreement was secured with a tractor. The debtor has faced financial problems since the autumn of 2022 and hasn’t made any payments from December 12, 2022. Consequently, HeavyFinance initiated debt recovery actions, sent official notices, and eventually terminated the loan agreement on March 1, 2023. On March 22, they sought a notary for the issuance of an enforcement order, which was granted on May 29. On the same day, the enforcement document was handed over to the bailiff to initiate enforcement actions. The borrower was informed about the commencement of debt recovery proceedings and actively sought a new creditor for loan refinancing.

While the bailiff began the recovery process, a request was received to halt all proceedings. On August 23, consent was granted for the sale of the property to the buyer chosen by the borrower. The sale was successfully executed, and the money was distributed between the investors on September 30, 2023.

LT0000055 Terminated on 2023-03-08

The loan agreement was secured with the land plots and buildings on it. In the autumn of 2022, the borrower encountered financial difficulties and failed to make any payments from December 9, 2022. Consequently, HeavyFinance initiated debt recovery actions, sent official notices, and eventually terminated the loan agreement on February 24, 2023. On March 16, the HeavyFinance team sought a notary for the issuance of an enforcement order, which was granted on May 15. The borrower was duly informed about the commencement of debt recovery proceedings and actively sought a new creditor for loan refinancing. Additionally, she requested to stop all recovery processes, as she had eight loan agreements to manage, all of which required finding new creditors. She gradually settled all the loans herself, and to this day, only one loan agreement remains unpaid.

LT0000715 Terminated on 2023-08-24

The loan agreement was secured with land plots. In the autumn of 2022, the borrower encountered financial difficulties as the financial obligations of the farm became difficult due to a significant decline in milk purchase prices amongst other factors.

Following a delay of 192 days, the borrower began to gradually make the payments. Eventually, they decided to seek a financial partner who could provide refinancing terms that would allow her to meet her commitments.

While the borrower searched for a financial institution, HeavyFinance initiated the debt recovery process and ultimately terminated the loan agreement on August 24, 2023. Process documents for a notary for the issuance of an enforcement order were being prepared, but this step became unnecessary as the loan was refinanced with another credit institution, and all obligations under the loan agreement were duly settled.

Recovery

During September 2023, 154.8K EUR was recovered from defaulted loans (loans, where the contract with the borrower is terminated and a hard recovery process was initiated) and distributed to investors. The total recovered funds from defaulted loans amount to 1.27M EUR.

The chart below represents recovery in time. The principal amount that defaulted in 2021 H2 is recovered in full with interest, setting a 110.35% recovery rate.

We are entering the period where farmers are receiving payments for the harvest, so an increase in repayments is expected throughout the 4th quarter.

Happy investing!

HeavyFinance team

Not yet a HeavyFinance investor?

Fill out a quick registration form and start investing!